Exports plummet due to US-China dispute

… Korea Bank “Similar to the financial crisis”

http://www.chosunonline.com/site/data/html_dir/2019/08/09/2019080980003.html

Reporter Kim Tae Kun / Chosun Ilbo Japanese version

BankKoreaSimilarToFinancialCrisisLoans1000₩

경제 위기 때 마다 부동산 꺾 였는데… ' 트라우마 ' 살아 나나

국내 부동산 대출 1700 조원 육박… 가계 는 1000 조 넘어서

Is the 2019 financial crisis approaching ?!

How to minimize damage in preparation for now !

Kim Mi Kyung ’s Dream Money Asia National Team

Futurist Choi Yun-sik # 1

Subtitles-Settings-Subtitles ( 1 )-Automatic translation-Language

Since May this year,

the Bank of Korea has shown that the US-China trade dispute has escalated

and South Korea's export decline has expanded .

The decline in exports is similar

to the global financial crisis in 2008 and the collapse

of the IT bubble in the first half of 2000 .

On the 8th , the Bank of Korea separates

with the announcement of the currency credit policy report.

"The impact of the recent US-China trade dispute

on the Korean economy "

Analyze

“Since May this year, the decline in exports has increased rapidly,

but it has been found to be highly correlated

with the spread of US-China trade disputes.”

Pointed out.

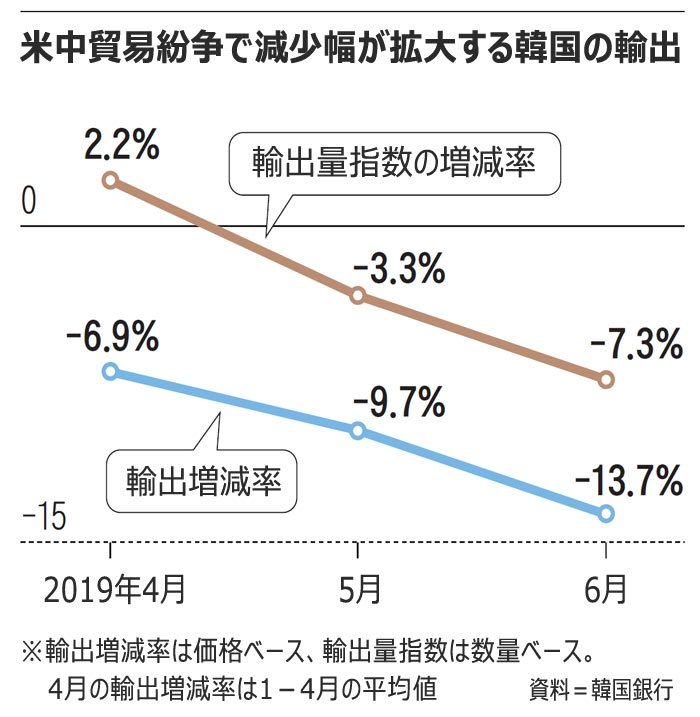

Exports from January to April this year

decreased by an average of 6.9 %,

but the decline expanded by 9.7 % in May and 13.7 % in June .

As a result of examining the export volume index excluding imports

and exports of ships, the Bank of Korea increased 2.2 % in April this year,

but fell to 3.3 % in May and expanded to 7.3 % in June . .

The Bank of Korea

“The US-China trade dispute has increased

the uncertainty of the global economy and trade,

which has contributed to the decline in exports in Korea.”

And analyzed.

The BOK said that the US-China trade dispute was showing

a similar trend t

o the collapse of the IT bubble in 2000

and the global financial crisis in 2008 .

The view is that the Korean economy, which relies on exports,

will be the first to have a severe impact as major evils emerge

and raise the uncertainty of the global economy, thereby reducing world trade.

In 2000 , the IT bubble collapsed and stock prices crashed around the world.

Economic uncertainty has increased and South Korean exports have declined.

At the time of the 2008 financial crisis

, South Korea's exports plummeted following the collapse of Lehman Brothers.

The Bank of Korea

“Uncertainties associated with US-China trade disputes are expected

to continue for the foreseeable future,

and changes in global trade conditions

and their impact on the domestic economy need to be carefully monitored.”

Pointed out.

In the report,

the BOK cited not only the US-China trade dispute

but also the recent economic conflict

between Korea and Japan as a factor to increase the uncertainty

of the Korean economy.

The Bank of Korea

“At present, the development of external risk factors is difficult to predict.

We will continue to check the situation in detail ”

Said.

South Korea exports rapidly decreasing

due to US-China conflict .

Brown, change rate of export index

Blue, export increase / decrease rate

Household real estate loans exceed 1000 trillion won

http://www.chosunonline.com/site/data/html_dir/2019/08/09/2019080980007.html

Reporter Kim Tae Kun / Chosun Ilbo Japanese version

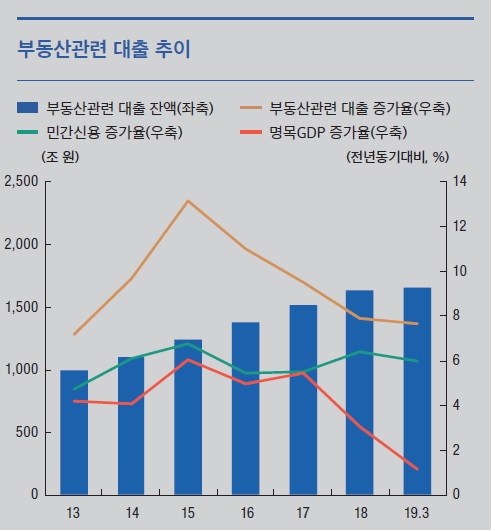

According to a currency credit report released

by the Bank of Korea on the 8th ,

the real estate loan balance of Korean households exceeded 1000 trillion won.

However, the growth of the balance was found to have decreased rapidly

in the last year.

As of the end of March ,

the scale of real estate-related loans to households and companies

by Korean financial institutions was 1668 trillion won

( about 146,050.5 billion yen , about 1,378 billion US dollars ) ,

of which household loan balance was 1002 trillion won

( About 87,815.2 billion yen , about US $ 828.5 billion ) .

The totals of the Bank of Korea include real estate-backed loans,

collective lean (such as mid-sized money loans provided

when condominiums are sold), real estate rental guarantee loans,

and real estate project loans ( PF ).

The total balance of real estate loans increased

by 7.7 % compared to a year ago,

which was significantly lower than the 13.2 % increase in 2015 .

However,

taking into account that nominal GDP (nominal GDP )

in the January-March period of this year increased

only 1.2 % year-on-year, it still outpaces economic growth .

By economic entity, household real estate loan balances

increased 4.3 % year-on-year, while companies increased 13.9 %.

The increase in real estate lending to companies was greater

than that of households.

The Bank of Korea

“This is because the demand

for lending in the real estate leasing industry among companies has increased,

while regulations on household lending have been tightened,

and banks have strengthened their lending business.”

And analyzed.

Due to the rapid increase in corporate loans,

the ratio of companies to total real estate loans increased

from 33.9 % at the end of 2013 to 40.0 % at the end of March this year.

Although the fear of a surge in household debt related to real estate seems

to have receded, the BOK is in a position that it is "fast to worry".

The Bank of Korea

“The interest rate on loans has declined due to a reduction

in the policy interest rate, and this year's apartment occupancy

( 211,000 units) in Seoul and the Tokyo metropolitan area has exceede

d the average of the last five years by 40,000 units. There is a need"

Pointed out.

https://www.hankyung.com/society/article/201908081793Y

On the other hand, looking at the “Causes

and Impacts of Manufacturing Employment Loss” section

of the Currency Credit Policy Report,

manufacturing employment problems

were concentrated on temporary day labor .

He experienced poor employment in his 30s and 40s .

There are also concerns that it will not be easy for the manufacturing industry

to improve in a short period of time,

such as the US-China trade dispute and Japan's export restrictions.

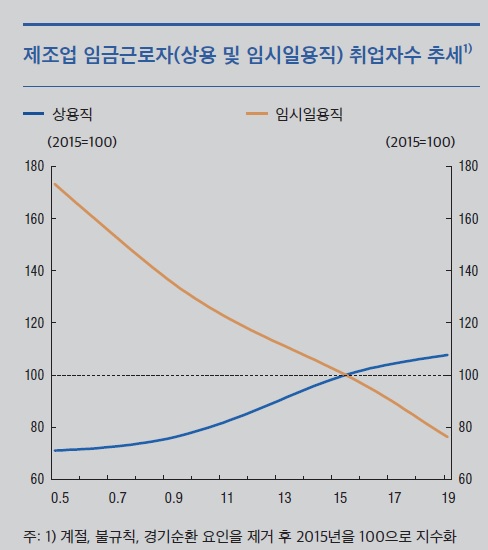

As a result of indexing the number of workers in the manufacturing industry,

the number of temporary workers was 76.2 in the first quarter of this year,

with 2015 as 100 .

By removing seasonal factors and factors associated with the business cycle,

it means that the manufacturing industry

and temporary daily work decreased significantly compared to 2015 .

Conversely, in the case of regular employees,

employment was moderately increased

from 2015 at 107.7 in the first quarter of this year.

The Bank of Korea explained that this was the result of a decrease

in labor demand, especially in simple and repetitive operations ,

due to labor-saving technological innovation.

Looking at changes in the employment rate by age,

the employment rate for 30-49 years

in the first half of this year fell 0.4 percentage points year-on-year.

Conversely, it increased by 0.3 percentage points for those aged 50 to 54,

and 0.5 percentage points for those 55 and older.

Economic crisis, economic downturn,

Korean economic outlook,

How to avoid the financial crisis

(Feat. Financial Stability Report )

1. Financial stability index

-'19 May , principle (attention) stage

-Increased delinquency rate of non-bank money lending

-Increase in corporate credit lending, bad corporate bonds ↑

2. Private credit / Nominal GDP

-Quarter talk 189.1% ( previous year 1.4% ↑)

-Household debt 1,540 trillion ( 4.9% up from the previous year )

-Corporate lending 842.5 trillion ( 4.8% ↑ last year )

3. Household credit

-Household credit 1500 trillion ( 4.9% up from the previous year )

-Disposable income relative to household debt (state , stock)

-Impact and forecast of DSR

-The slowdown in the rate of increase

in household debt is the real estate market stagnation

4. Financial debt ratio

-Significant decline in asset growth rate

-If the rate of increase in debt is greater than the rate of increase in assets

( increased debt repayment burden )

5. Household loan delinquency rate

-Shifting upward trend since 2018

-Increase in non-bank household lending

( mainly due to housing collateral lending )

6. Household credit by type of loan

-Decrease in housing collateral lending

-19- year loan drastically reduced Loan regulation (DSR)

7. Trends in high-risk furniture

-Decrease in 1- minute commission debt ? Will the financial crisis close?

-Decrease in financial liabilities by 5- minute committee

8.High risk group furniture

-Large real estate ownership is high

-Chayong Apcha Financial Debt 52.2%

-Maturity day market (poetry) redemption

9.Capital ratio by upright

-Banks : Regional banks, SME lending-centered capital ratio dropped significantly

-Securities companies : Large securities companies,

marketable securities and loans

10. Final conclusion

-Minimize loans and reduce change

11.Source

-Korea Bank : Financial Stability Report

http://www.bok.or.kr/portal/main/main.do