We pride ourselves in engaging with a range of local Islamic scholars and we are the only provider to be endorsed by the Board of Imams Victoria and President of the Imams Council of Queensland . Ijarah Finance operates under the principle of Rent-To-Own otherwise known as Ijarah Muntahiya Bil Tamleek – A Lease Agreement with Islamic Finance Sydney the option to own the leased asset at the end of the lease period. If the idea of owing your own property, vehicle or equipment via Ijarah appeals to you but you are currently paying off an existing mortgage we can help you replace it. Purchase a rural property without engaging in an interest-based contract. There are four different types of equipment or asset finance structures that your business can utilize in order to acquire assets such as vehicles, machinery and business equipment. Invest your hard-earned money the halal way to own the house and call it home.

Our experienced consultants can help your business reach new heights by offering Ijarah lease agreements to enable your business to acquire or lease assets such as motor vehicles, trucks, plant equipment, machinery & more. Find out the latest insights about Islamic finance and investments. Be part of a 4000+ member strong community that finances projects and ambitions through Islamic contracts. Find out the latest insights about super, finance and investments. We congratulate you for making the right choice and selecting the halal home loan alternative. Once you have completed and submitted this form, a dedicated MCCA sales executive will contact you within 1 business day to walk you through the next stage of your application.

You will also get an insight into how Islamic financial institutions use the principal contracts to service a wide variety of client requirements, across financing personal and business needs. Providing or obtaining an estimated insurance quote through us does not guarantee you can get the insurance. Acceptance by insurance companies is based on things like occupation, health and lifestyle. By providing you with the ability to apply for a credit card or loan, we are not guaranteeing that your application will be approved. Your application for credit products is subject to the Provider's terms and conditions as well as their application and lending criteria. We try to take an open and transparent approach and provide a broad-based comparison service.

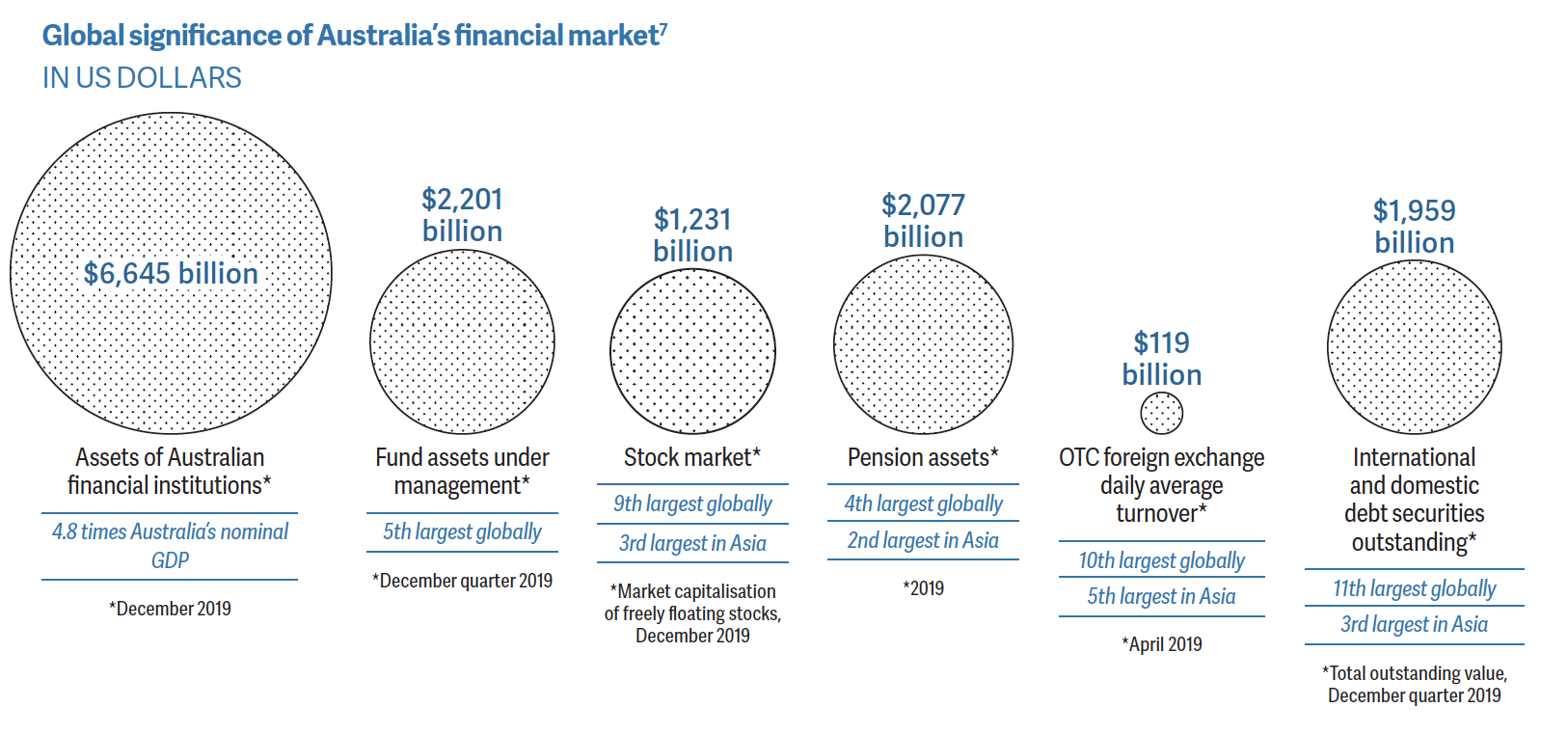

In fact, the World Economic Forum recently ranked Australia as the second among the world's financial centres, behind only the United Kingdom, primarily due to the stability of our financial institutions over the past 12 months. The tax treatment of Islamic financial products should be based on their economic substance rather than their form. Fees and charges may apply, as well as terms and conditions which you should review. In order to open a credit product in future, you will need to meet our credit criteria and be approved. Please review the product disclosure documentation provided at the time of opening your account for detailed information.

“We’re really proud to be able to offer such a valuable service to Australia’s Muslim community,” said Dr Imran Lum, director of Islamic finance at NAB’s Deal Structuring and Execution team. “The bank was very nice and they came back and said ‘OK, if you don’t want any interest, we will eliminate your banking fees’,” recalls Professor Bhatti, the founding director of the Islamic banking and finance program at La Trobe University. Islamic Bank Loans To be eligible Islamic home loans, apart from having the Muslim faith, you’ll also need to provide proof of funds for your deposit, savings and employment history as well as information related to any other assets or liabilities you have. This flexible variable rate home loan offer from a digital lender is suitable for both home buyers and investors. The financial institution makes money by charging a profit rate on your rental instalments.

Our Ijarah products can be tailored to suit individual and business needs. The Big Four bank has worked closely with Amanie Advisors, a global firm specialising in helping companies that want to be Sharia compliant, to create an offering that appeals directly to the Muslim community in Australia. NAB have announced a market first for Australian SME lending by building a bespoke Islamic finance product for their small business customers. Be able to use critical thinking and apply problem solving skills in the application of Islamic banking and finance. Meanwhile Islamic Banking Australia - a group of Muslim Australians and industry veterans - have applied for a licence for a digital bank that is totally sharia-compliant.

"The Bahrain Central Bank made a very generous offer today to work with Australian regulators as we boost our readiness for a range of Shariah-compliant products, both wholesale and retail." The Board has completed its review of the taxation treatment of Islamic Finance and provided itsreport to the Assistant Treasurer. In preparing its report the Board took into account the various submissions to the review and discussions with stakeholders and its expert panel. To assist in the Review process, the Board conducted consultation meetings on 8 November 2010 in Melbourne and 11 November 2010 in Sydney.

CPA PD Islamic finance Online

After a successful pre-assessment a finance executive will prepare your application for submission. We will request specific information to support your application. The information we request will vary depending on your personal circumstances and includes documents to support income, deposit or equity, assets, liabilities such as current mortgages, car loans, credit cards etc. MCCA is Australia’s leading Shariah compliant finance and investments provider.

There are no significant commercial benefits or features of Islamic home loans that wouldn’t be offered with a non-Islamic-compliant loan. “Islamic finance is largely Sharia Bank Loans about the philosophical side of things – it’s where Western banking meets Islamic banking. We offer an alternative solution for Muslims in an Australian landscape. Islamic finance is underpinned by Sharia values that are consistent with Islamic legislation. The fundamental principles concerned with Islamic home loans are outlined below. As general manager of Iskan Finance, Russell Murphy states, “For our customers, at the date of settlement, they are registered as the owner.

Depending on the financial institution, Islamic home loans may be slightly more expensive than non-Islamic home loans. However, this will depend on how Halal Finance the financial institution determines the profit made on the sale. Although, technically, interest isn’t charged for an Islamic home loan, the financial institution will still be charging fees in the form of rent or profit rate. Make sure you have a clear understanding of exactly how much extra you’re being charged as a result of the profit rate. Murphy stresses that when comparing Islamic home loans, you should keep an eye out for the service level offered by the provider. “Ours is a common mortgage transaction that’s fully functional.

Mr Gillespie also said that Islamic banks were inherently ethical, refusing to deal with certain industries. “With the number of Muslims in Australia growing by more than 6% every year, we’re excited to be bringing this new type of banking to the Australian community,” said Islamic Bank Australia CEO Dean Gillespie. Mr Gillespie was formerly Head of Home Loan Distribution at Commonwealth Bank, and Head of Mortgages at Bankwest. With the number of Muslims in Australia growing by more than 6 per cent every year, we’re excited to be bringing this new type of banking to the Australian community,” the CEO added. As we unpack the multiple facets to social governance in our industry, financial inclusion comes to the forefront — and what we’re seeing is that Australia still has a long way to go. Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product.

We acknowledge the Aboriginal and Torres Strait Islander peoples as the first Australians and Traditional Custodians of the lands where we live, work and bank. We do not currently meet the full prudential framework and/or requirements, and you should consider this before depositing funds with us. After the completion of our “restricted” phase, we plan to obtain APRA’s approval so that we can publicly launch. Digital Banking Technology Digital First experiences in banking brings together the Islamic Finance innovation and capabilities of the latest technologies. Ethical banking is in our DNA; we make ethical decisions in whatever we do.

For security reasons please DO NOT provide any confidential or account specific information via email. Communications via email that are not encrypted are not secure. What you need to know as an MCCA customer, or more generally as a member of Australia’s Muslim community or the finance profession. System is currently experiencing issues and we are working on a solution.

This authorisation allows us to offer banking services, but is subject to certain restrictions such as a cap on the amount of deposits that we can hold in total. The purpose of the “restricted” status is that we can test our systems and processes before launching as a fully unrestricted bank. Be able to use critical thinking and apply problem solving skills in the application of Islamic banking and finance. Meanwhile Islamic Banking Australia - a group of Muslim Australians and industry veterans - have applied for a licence for a digital bank that is totally sharia-compliant. To meet