Conventional medical insurance strategies offer coverage for the therapy of coronavirus (COVID-19). Nonetheless, the treatment of coronavirus includes numerous types of pre-hospitalisation, hospitalisation, post-hospitalisation, as well as treatment costs throughout quarantine. Therefore, it is important to go with temporary medical insurance plans, particularly Corona Kavach and Corona Rakash, especially created to provide coverage only for coronavirus therapy costs.

- This can be important, due to the fact that if you consistently see an expert, then you might lose http://sergiocoxc799.theglensecret.com/recognizing-medical-insurance the capacity to head to that treatment service provider if they are out-of-network.

- It covers medical costs incurred on a hospital stay, surgical procedures, daycare procedures, etc.

- When you restore your health insurance plan it keeps your loved ones protected.

- Corona Kavach Plan covers Covid hospitalisation expenses, Ambulance cover, house treatment expenses, pre as well as post hospitalisation costs, AYUSH therapy and ICU expenditures.

Get a side-by-side contrast of common clinical advantages and prices for services. Note that most medical insurance funds have a considerable variety of medical facilities you might choose from. If you operate in The Netherlands you are called for to request a basic medical insurance. Did you recognize that your medical insurance might offer you refund in the direction of the cost of your children's subscription to sporting activities club ...

Reliance Health Insurance

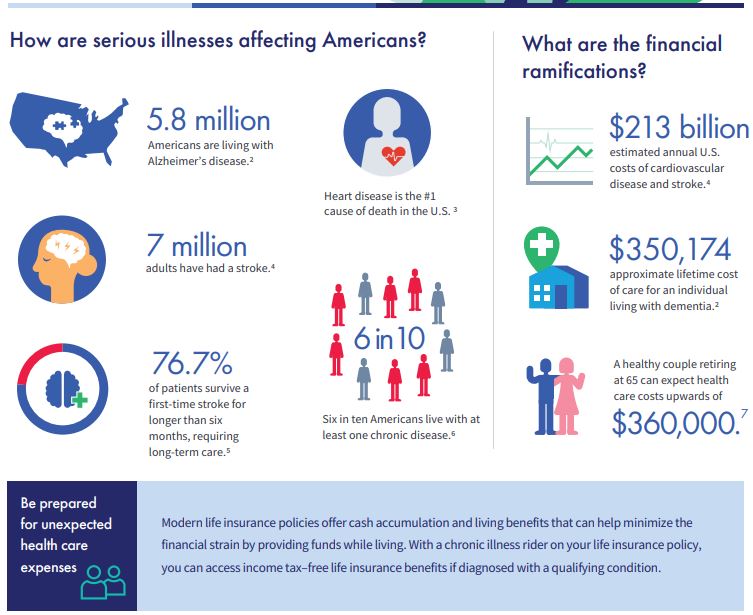

An additional factor to obtain health insurance cover is that it helps you combat lifestyle conditions such as cancer cells, kidney failure, stroke, paralysis, cardiovascular disease, and so on. These diseases are most typical in people over 45 years of age but as a result of inactive lifestyles, tension, pollution, and so on these are currently impacting children also. A detailed medical insurance strategy that covers you for routine medical examination not just aids you determine the conditions, however additionally provides financial defense in case of their therapies. As well as the increasing price of medical treatment in such times only makes the scenario even worse.

Pre & Post A Hospital Stay Expenses

Comparing medical insurance plans online involves browsing through different strategies, going through the problems such as area rent, waiting period, claims The original source process, and so on. This way, you recognize without a doubt that the final decision you make is based upon concrete Find more information analysis keeping your demands in mind. When using our compare device and also searching health insurance intends you will certainly notice that policies are categorized by steel rates. The steel rates are set apart by the quantity you would spend for costs, deductibles, out-of-pocket optimums, and coinsurance or copays.

Importance Of Medical Insurance Plan In India

These expenses can be availed by paying a repaired amount called costs. A medical insurance policy gives these expenditures in the form of either reimbursement or cashless therapy. You can currently acquire or restore your covid particular medical insurance policies, Corona Kavach and also Corona Rakshak, approximately September 30, 2022. Corona Kavach Policies and also Corona Rakshak Policies are special insurance coverage plans that safeguard the insurance holders versus the pocket burning costs of Covid-19. Corona Kavach plan is offered by general and medical insurance business only, while the Corona Rakshak plan may be supplied by all insurance firms, consisting of life insurance firms. Based on that, you could intend to determine your premium to determine how much you would certainly have to pay for the plan.