Introduction

The world of trading is dynamic, fast-paced, and filled with opportunities for those who can navigate its complexities. However, jumping directly into real-world trading without experience can be a costly mistake. That’s where trading game come into play. A trading game is a simulated environment where players engage in buying and selling assets like stocks, forex, or cryptocurrencies without risking real money. These games are designed to teach trading strategies, risk management, and market dynamics in a fun and interactive way.

In this article, we will explore the concept of trading games, their benefits, popular platforms, strategies for success, and how they compare to real-world trading.

What is a Trading Game?

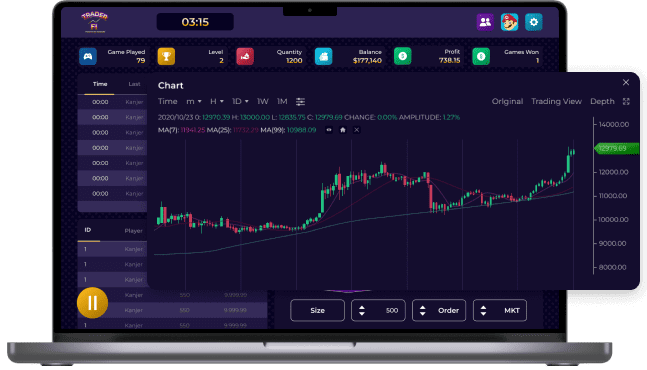

A trading game is a virtual platform that replicates real market conditions, allowing players to practice trading strategies. These games use real-time or historical data to simulate market fluctuations, giving players an authentic experience. Players can trade stocks, commodities, forex, cryptocurrencies, or even fictional assets, depending on the platform.

Trading games can be categorized into three main types:

-

Educational Trading Games – Designed for beginners to learn the fundamentals of trading and investing.

-

Competitive Trading Games – Players compete against each other, often with leaderboards and rewards.

-

Simulation Trading Platforms – Provide a realistic trading environment with features similar to actual trading platforms.

Benefits of Playing Trading Games

Trading games offer numerous benefits, particularly for aspiring traders and investors. Here are some key advantages:

1. Risk-Free Learning

Since trading games use virtual money, players can experiment with different strategies without financial risk. This allows beginners to build confidence before entering real markets.

2. Understanding Market Behavior

Trading games often use real-time or historical market data, helping players understand price movements, trends, and market dynamics.

3. Developing Trading Strategies

Traders can test various strategies, such as day trading, swing trading, or long-term investing, and analyze their effectiveness.

4. Enhancing Decision-Making Skills

By making simulated trades, players develop critical thinking and decision-making skills, which are essential for successful trading.

5. Competing and Engaging

Many trading games have leaderboards, challenges, and competitions, making learning engaging and motivating.

Popular Trading Games and Simulators

Here are some of the most popular trading games and simulators available today:

1. Investopedia Stock Simulator

A widely used educational platform that allows players to trade real stocks with virtual money. It provides an excellent environment for beginners to practice and understand market behavior.

2. Wall Street Survivor

This game combines trading with financial education, offering tutorials and lessons alongside trading challenges.

3. MarketWatch Virtual Stock Exchange

A real-time stock trading simulator that allows users to create their own games and compete with others.

4. Stock Trainer: Virtual Trading

A mobile app that provides a realistic trading experience with real stock market data.

5. TradingView Paper Trading

A feature of the TradingView platform that allows users to trade virtually using their powerful charting tools.

6. Forex Tester

A simulator for forex traders that lets them backtest strategies using historical data.

Strategies for Success in Trading Games

While trading games provide a risk-free environment, treating them as serious learning tools can significantly enhance real trading skills. Here are some strategies to maximize benefits:

1. Set Realistic Goals

Approach the game as a learning experience rather than just a competition. Set specific objectives, such as mastering a particular strategy or improving risk management.

2. Experiment with Different Strategies

Try out various trading styles, including day trading, swing trading, and long-term investing, to see which suits your personality and goals.

3. Use Technical and Fundamental Analysis

Learn to read charts, indicators, and financial statements to make informed trading decisions.

4. Manage Risk Effectively

Practice using stop-loss orders and position sizing to minimize losses and maximize gains.

5. Keep a Trading Journal

Document your trades, strategies, and outcomes to analyze mistakes and successes.

6. Engage in Competitions

Participating in trading competitions can enhance learning and provide insights into different trading styles.

Trading Games vs. Real-World Trading

While trading games are excellent learning tools, there are some key differences between simulated and real-world trading:

1. Psychological Differences

Trading with virtual money lacks the emotional pressure of real money trading. Real trading involves fear, greed, and stress, which affect decision-making.

2. Liquidity and Execution Differences

In real markets, factors such as slippage, order execution speed, and liquidity can impact trade outcomes, which are often not reflected in trading games.

3. Lack of Real-World Consequences

While losing virtual money in a game has no real consequences, real trading losses can be financially significant.

4. Market Manipulation and Spreads

Real markets involve bid-ask spreads, commissions, and market manipulation, which are sometimes absent in trading games.

Transitioning from Trading Games to Real Trading

If you have mastered a trading game and want to transition to real trading, here are some tips:

-

Start with a Demo Account – Before using real money, trade on a demo account to experience market conditions without risk.

-

Begin with Small Investments – Avoid investing large sums initially. Start small and gradually increase as you gain confidence.

-

Apply Risk Management – Use stop-loss orders and proper position sizing to protect your capital.

-

Control Emotions – Develop discipline and avoid impulsive decisions driven by fear or greed.

-

Keep Learning – Markets evolve, and continuous learning is essential for long-term success.

Conclusion

Trading games are a valuable tool for learning market dynamics, testing strategies, and developing trading skills without financial risk. Whether you are a beginner looking to understand the basics or an experienced trader honing your skills, trading games provide a safe and engaging platform to enhance your knowledge.

While they cannot fully replicate the psychological and technical challenges of real-world trading, they serve as an excellent stepping stone for those interested in entering the financial markets. By treating trading games seriously and applying their lessons to real trading, aspiring traders can increase their chances of long-term success in the competitive world of finance.