Term life insurance, also understood as pure life insurance, is a kind of life insurance that guarantees payment of a stated death advantage if the covered individual passes away during a specified term. When the term ends, the insurance policy holder can either renew it for another term, convert the policy to long-term coverage, or permit the term life insurance coverage policy to terminate.

Term life insurance coverage warranties payment of a mentioned survivor benefit to the insured's recipients if the guaranteed person dies throughout a defined term. These policies have no value aside from the guaranteed survivor benefit and feature no savings part as found in an entire life insurance item. Term life premiums are based on an individual's age, health, and life span.

When you buy a term life insurance policy, the insurance provider determines the premiums based upon the worth of the policy (the payment amount) along with your age, gender, and health. Sometimes, a medical exam may be needed. The insurance coverage business may likewise ask about your driving record, current medications, smoking cigarettes status, profession, hobbies, and family history. If you die during the regard to the policy, the insurer will pay the stated value of the policy to your recipients. This cash benefitwhich is, most of the times, not taxablemay be used by recipients to settle your health care and funeral service costs, consumer financial obligation, or mortgage financial obligation to name a few things.

You might be able to restore a term policy at its expiration, but the premiums will be recalculated for your age at the time of renewal. Term life policies have no value besides the ensured death advantage. There is no savings element as discovered in a entire life insurance item.

Rate of interest, the financials of the insurance coverage business, and state policies can likewise Article source impact premiums. In basic, companies frequently offer much better rates at "breakpoint" protection levels of $100,000, $250,000, $500,000, and $1,000,000.

There are several different kinds of term life insurance coverage; the best alternative will depend on your individual scenarios.

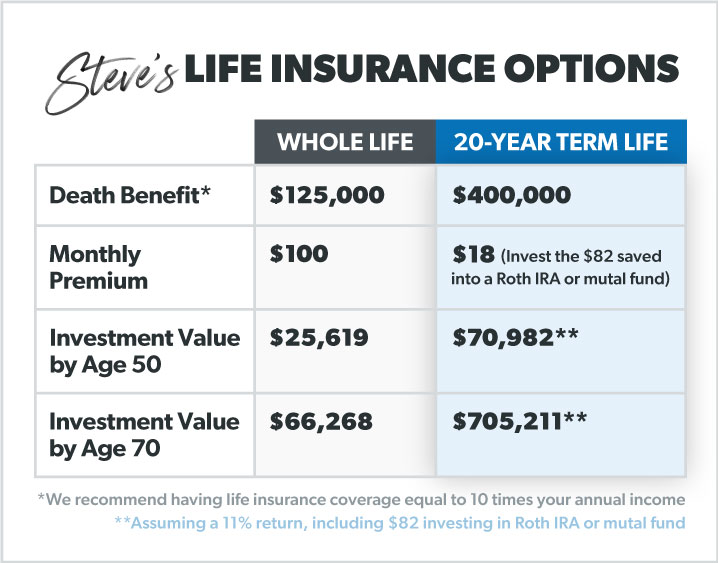

The main differences between a term life insurance coverage policy and a permanent insurance plan, such as universal life insurance, are the duration of the policy, the build-up of a cash worth, and the cost. The right option for you will depend upon your needs; here are some things to think about.

Term life policies are ideal for individuals who desire significant protection at low expenses. Whole life customers pay more in premiums for less coverage however have the security of knowing they are safeguarded for life. While many purchasers favor the price of term life, paying premiums for an extended duration and having no benefit after the term's expiration is an unattractive function. Upon renewal, term life insurance premiums increase with age and may become cost-prohibitive over time. In truth, renewal term life premiums may be more costly than permanent life insurance coverage premiums would have been at the issue of the original term life policy.