The Single Strategy To Use For Life Insurance Law Firm

It's uncommon for a life insurance coverage company to deny a life insurance claim. However, it's not difficult. A life insurance company may deny the death advantage if the policyholder misrepresented information on their application, due to the way of death, or since the policy lapsed without your knowledge, among other factors. If your claim is turned down, the insurance company will refund the premiums paid into the policy and end it. The insurance company ought to recognize why the survivor benefit was withheld, but it's unlikely they'll reverse their decision unless there's been a genuine error. Survivor benefit are denied only in specific scenarios, like if the insured pushed their application, The insurance provider should offer a clear description of why they denied the claim, It's unworthy contesting a denial unless you have proof that there's been a mistake, Your state insurance coverage department or lawyer can assist you object to the denial, but you can likewise appeal it by yourself, There's no guarantee that you'll have the ability to get the supplier to pay a denied life insurance coverage claim.

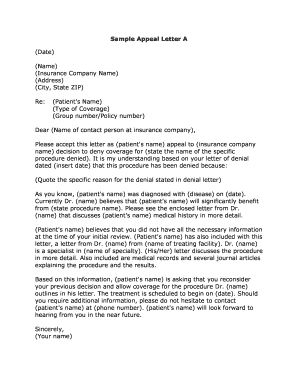

Start by getting in touch with the insurer to ask for more details about your claim. If, after speaking to an insurance coverage representative, you still feel your claim has actually been managed poorly, you might think about submitting a grievance with your local department of insurance. Your insurance supplier can share additional details about why they rejected your claim and offer you insights on their appeals process. Depending on why the claim was rejected, you might need to present medical documents, an autopsy report, or evidence of insurance coverage premium payments to support your case. An insurance representative can tell you what's needed for your scenarios. life insurance law firm.

Working with the company straight can be complex and stressful while you're grieving, however might be the most efficient and inexpensive alternative. Calling government agencies might offer your appeal more weight, however could take time to produce results. If you decide to file a suit over a rejected claim it can be pricey, and the final judgment may not give you the complete insurance benefit. Nevertheless, some attorneys may be able to help you submit an appeal without involving a lawsuit. If a company rejects your life insurance claim, expect to receive some sort of written communicationoften called an explaining their choice in information.

The Single Strategy To Use For Lawyer For Life Insurance Claims

" Perhaps they're not the beneficiary that's noted or the individual passed away by suicide in the first two years." Beyond that, Herskovits states, it's unlikely you'll ever see a claim denied. Some extra situations where you might face rejection are: If your claim is rejected for any of the reasons above, you won't have much success appealing the supplier's choice. Life insurance policies consist of language that voids your coverage for non-payment or if you lie during the application procedure. Similarly, a lot of policies include a suicide provision, which rejects the survivor benefit if you die due to self-harm within the very first two to 3 years of purchasing a policy.

If somebody passes away within the very first two years of getting their life insurance policy, their death falls under the policy's contestability period. life insurance lawyer. During this time, the insurer may perform an additional evaluation of a death advantage claim to look for any scams or misrepresentations made on the application. If you deny having any risky hobbies but the service provider finds that you hid the truth that you're an amateur pilot, they can deny a claim even if your death had nothing to do with flying. A contestability evaluation can postpone the claims procedure but as long as the deceased was truthful, the company will pay out the death benefit.

This will delay the claims procedure and if a beneficiary is linked in the murder, their claim will be denied. In that case, the payout goes to the contingent recipient, if one was called, or a court decides who gets the death advantage. Compare the market, right here. Policygenius conserves you up to 40% by comparing the top-rated insurance providers in one location (Denied Life Insurance Claim Lawyer). It's natural to feel some anxiety that your death claim could be rejected. Nevertheless, life insurance claims are various from house, health, or vehicle insurance coverage claims, where there's a higher opportunity of rejection based upon your policy terms.

Appeal Denied Life Insurance Claim for Beginners

We don't advise contesting a denied claim other than in extenuating circumstances where you have exceptional evidence. If a life insurance company has actually rejected your claim due to a policy lapse, for instance, you 'd need to offer solid proof of premium payments to win an appeal. Otherwise, contesting a life insurance claim rejection is not worth the time or effort. A death claim can be declined if the policy lapsed, the insurance policy holder rested on their application, if the cause of death is suicide within the very first couple of years of the policy, or if the recipient killed the insurance policy holder. It's uncommon for survivor benefit declares to be denied. Denied Life Insurance Claim Lawyer.

If you believe your death benefit claim was wrongfully rejected by the insurance provider, you can contest it directly with the provider or deal with your state insurance department or an attorney to contest the rejection.

When individuals acquire a life insurance coverage policy, they are thinking of their enjoyed ones' future. In case of a policyholder's death, that protection can provide the family with much-needed financial backing. Unfortunately, insurer frequently deny recipients the cash they deserve. As they're dealing with a disaster of losing an essential individual in their lives, they're likewise struck with the truth that they won't receive those benefits on which they were depending. If you've discovered yourself in this scenario, we can assist. Below is a guide to life insurance rejections and how to win a life insurance coverage claim appeal. appeal denied life insurance claim. The claim process for life insurance recipients is typically easy.