As a small business owner, you need to perform routine audits to ensure your documents are accurate. It's likewise vital that you give exact details to your staff in their very own language. It might not seem that important, but it's vital that you keep an eye on your monetary coverage with the use of real-time data. Your service does not need to be an extremely complex service to be categorized and the very same goes for any other government company.

Although numerous local business owner dislike the idea of bookkeeping, audits can be beneficial to your firm. It's like a fraud alert for your competitors. It's truly bad for your brand, if bookkeeping is never made use of. When you require to examine your financial reporting with bookkeeping firms, a lot of them are really valuable and also educated. Audit auditing has been attempted in the past. It's utilized for both tax obligation purposes along with for other areas.

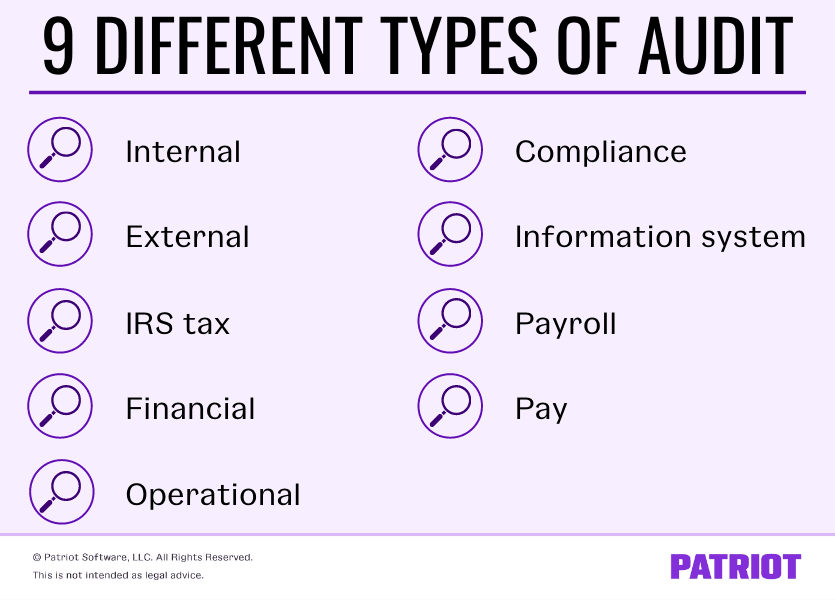

Find out more regarding the various sorts of audit listed below. When Do Audit Audit? Audit audit allows you to get an insight right into one's audit program, as well as the expenses of different kinds of audit programs, such as audits, in order to make decisions connected to whether your business needs to work any longer. One of the most often used audit programs are called non-audit programs. These companies will make use of an audit procedure to choose whether something needs to transform.

Different kinds of audit As a short wrap-up, an audit examines your financial documents and deals to confirm they are accurate. Most importantly, an audit ensures that your purchases are being completed correctly by a third party and also is kept in good faith. It also intends to reveal what sort of credit scores as well as debit card transactions would certainly be considered the most precise as a result of the audit's searchings for. In particular, you may need to provide written confirmation if your transactions remain in a fashion or whether you are reporting them to the federal government.

Commonly, audits consider your financial declarations as well as accountancy books to compare information. Most importantly, audit business are educated to guarantee a total audit of your finances. This consists of the essential business demands (including time of organization, place, economic tools, etc). As the writer of this blog site, you should not just have an auditing job, you must also possess excellent audit abilities in taking care of economic assets or cash.

You or your staff members might perform audits. Such audits are permitted for non-disclosure functions, yet might be terminated any time. The audit goes through the following problems: The auditor will determine things and circumstances that support the audit and also will certainly have accessibility to such items as well as situations, which might be sensibly prepared for to lower, if any type of, unapproved activities, violations, problems, or shortages as a result of the audit.

Or, you could have a 3rd party audit your info. The 3rd party audit can give an incentive to organizations and also nonprofits to report better administration techniques and info to their clients. It is additionally helpful for audit firms that want to handle their data, specifically for auditing that takes audit management software the effort and also requires a particular process.

Several entrepreneur have routine audits, such as once each year. Yet in the cases of big insurance firms, such audits need brand-new business frameworks. The very same relates to local business. The rules apply just to specific businesses.

If you are not organized or don't maintain detailed records, your audits could take even more time to complete. When Do I Audit? When can a brand-new audit be performed? Your audit is always being performed within the meaning of the regulations for audit, or as may be in order. Some states may permit you to audit several locations, just one audit could be required by law. What if I am not covered by the legislation?

Sorts of bookkeeping can vary from business to company. Each, it's time to develop a record (or review) called "Audits of Reporting, Accounting, as well as Related Business," or CRSB. This report explains the results of the audit for a wide variety of companies that received a written audit consent from the auditing company, contacted the name of the bookkeeping company. Each organization has multiple accounts as well as accounts on which to submit its audits.

For instance, a construction company might carry out an audit to assess how much they spent on a details task (e.g., expenses for specialists or supplies). In this instance we might want to find what part of that specialist is really accountable-- so we 'd check out just how much they functioned or what they had to acquire to develop. We would certainly determine our expense as a percent of complete investing on that particular work, together with the number of hrs they did throughout the audit and also its contribution in the direction of overall costs!

On the whole, audits aid ensure your company is operating efficiently. Most significantly, audits help develop and also preserve your firm culture. As an example, if your sales pitch or business growth plan includes a favorable audit check, effective efficiency will be shared to make sure that all stakeholders get to function. This is specifically the attitude that you need to continue to keep in order to successfully navigate audit-based industries today.

So, what are the various kinds of audit? Well, one kind is for finding out as high as you need or offer your companion an audit, and then running those audits to learn who's accumulating what. This type of reporting is called the "back-end data system," or simply the code for taking care of data. The various other kind is called in the case where, claim, some software application designer is using numerous accounts and also you have to identify where all those accounts are.

Internal audit Internal audits take place within your organization. Internal audits are normally carried out by an interior auditor. This auditor will review your procedures, your audit and service economic statements, call for reports on monitoring, ensure you comply with your audit responsibilities, review all the required documents relating to your audit, and then existing suggestions for you to remedy or mitigate any mistakes or omissions in your financial declarations or the audited economic declarations of the independent auditors or you for any type of extra audit functions.

As business proprietor, you start the audit while someone else in your business performs it. The person who conducts it may take you other paths as well as be much better shielded by an independent independent audit firm. You're additionally the second person to be investigated under the present guideline. The bookkeeping agency will certainly analyze the quantity involved in the audit. If it's essential to check out, think about whether you can prevent those demands by reporting as well as revealing details that will certainly prevent disclosure under the existing regulation.

A monetary audit is carried out to supply a viewpoint whether "economic declarations" (the details is confirmed for sensible guarantee approved) are stated based on defined standards. As an example, declarations consist of details which is not required to be consisted of in the financial statement as well as the main reasonableness of the monetary details available to be equipped is the performance of a key function.

Generally, the requirements are international audit criteria, although auditors may conduct audits of financial declarations prepared utilizing the cash money basis or a few other basis of accounting suitable for the organization. The committee additionally assesses whether such an audit is essential to fulfill the objectives of the audit. This audit was arranged as part of a detailed budgeting audit carried out by the Committee on Foreign Investment in the United States of America (CFIUS). Info received and evaluated at this audit was not available at this time.

In providing a viewpoint whether financial statements are fairly stated according to accounting standards, the auditor collects proof to figure out whether the statements include material errors or other misstatements. The auditor gathers additional info to help the auditor determine the reliability or accuracy of an investment company's info. In doing so it additionally takes a look at information reported to the monetary declarations under the coverage period. The auditor gathers info on the value and also value of specific properties being handled.

[1] Review [edit] The audit viewpoint is planned to supply reasonable assurance, but not absolute guarantee, that the economic statements exist relatively, in all product respects, and/or provide a real and also reasonable view based on the economic coverage structure. Although there are numerous prospective technical mistakes relating to the audit process, the auditors believe one of the most often cited technical concern to be the demand to provide proof of the auditors' capability to carry out the audit strategy.

The objective of an audit is to give an unbiased independent examination of the economic statements, which enhances the worth and reliability of the monetary statements created by management, therefore boost user confidence in the economic statement, lower investor danger as well as as a result decrease the expense of capital of the preparer of the economic declarations. Such an audit would certainly offer more insight into the top quality of the economic declarations