If you're thinking of obtaining a bank card in Thailand, you've concerned the right location. Credit cards in Thailand are ending up being more accessible, as well as you can make an application for one online in Thailand in mins. These cards provide a series of advantages, including loyalty programs as well as cost-free travel insurance. If you're making a suitable income, you can request a bank card in Thailand.

AEON Royal Orchid And also Platinum card

AEON has an unique online promotion for its charge card. Candidates are qualified for special benefits if they apply for the card online and also discuss the code WB-PO-NB-01 on top of their application. This promotion runs from 1 July to 28 February 2014. This deal is valid for the primary card just and also is not applicable to the Club Thailand card, AEON Wuttisak Visa, or Company card.

AEON Thana Sinsap, a Thai economic services firm, is displaying at Money Exposition Bangkok 2020. They will be using a variety of financial solutions to aid Thais prosper in their financial resources. A few of these solutions consist of Immediate Participant Card and Cash Loan by AEON Charge Card.

AEON Royal Orchid And also Platinum Card incentives vacationers with extra factors when they buy goods and services. They additionally offer a luxury luggage when you utilize the card to book trips on Thai Airways. Furthermore, the AEON credit card offers 3% cashback on all acquisitions. Those that invest over 300k baht in the very first year are qualified for a cost waiver. Additionally, AEON likewise provides complimentary travel insurance. The firm additionally allows its clients to use the Thai Airways lounge two times per year.

The AEON Royal Orchid And Also Platinum Card and also the Citi Royal Orchid Plus Preferred card both offer rewards points. As you invest money on both, you will certainly earn AEON Award factors and also ROP miles. You can likewise earn bonus incentive points when you spend a million baht in a year. You'll additionally be eligible for advantages like unlimited use Royal Silk Lounges at Suvarnabhumi airport terminal on Thai Airways trips. And also lastly, you'll be able to appreciate cost-free limousine solution for as much as 50 kilometers.

Most credit cards in Thailand include a commitment program. This implies that you can make points for shopping online or for making phone calls. However bear in mind that the very best method to utilize your commitment factors is to redeem them for air miles. Bangkok Airways has a frequent leaflet program called Flyerbonus, which is affiliated with Air Berlin, JAL, and also Etihad. Thai Airways is also a participant of the Celebrity Alliance.

Bank of Ayudhya

If you live in Thailand, you can request a Financial institution of Ayudhya card online. Financial institution of Ayudhya is one of the largest financial institutions in Thailand. Its branches can be discovered throughout the country. It supplies a wide array of economic solutions for both business as well as retail clients.

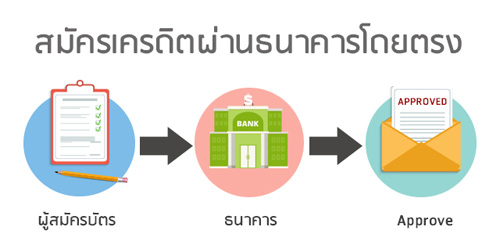

Candidates need to have a passport and a work permit. Candidates that are employed beyond Thailand should additionally have a job permit or a letter from their employer that claims they are utilized in Thailand. In addition, they must provide a proof of home in Thailand, which can be an utility expense or motorist's certificate. Some banks need a minimum deposit of several thousand baht.

Leaflet perk

The FlyerBonus bank card allows its members to make points for flying with picked Thai airlines. Points are valid for 3 years and also can be made use of to redeem advantages and solutions. The program supplies Concern and Premier degrees, which can lead to a range of benefits. Premier participants are eligible to delight in benefits such as Blue Bow Lounge Access, price cuts, and also extra baggage allowance. Participants gain up to 10 points per flight for flying locally with Thai airlines. Those that choose to fly organization or premier will gain as much as 35 points per flight.

FlyerBonus becomes part of the Bangkok Airways frequent flyer program, which works similar to Thai Airways' Royal Orchid And also program. Members of these programs obtain a 50% benefit when exchanging factors for miles with the airline company. They can likewise earn 5% money back at pick restaurants and resorts.

While it's not needed to obtain a Thai charge card to circumnavigate the country, it can help you minimize foreign currency surcharges and take pleasure in discounts at restaurants as well as hotels. The card likewise features benefits such as travel insurance coverage and also residence upkeep cover. Looking for a Thai charge card is easy, though some common demands might apply. In many cases, you'll have to pay a yearly charge.

Prior to completing a FlyerBonus credit card application online in Thailand, สมัครบัตรเครดิตออนไลน์ you need to know that you might undergo a couple of limitations. Bangkok Airways schedules the right to alter the policies as well as guidelines of the program. You need to additionally realize that the points and benefits of the program can transform.

One more downside is the international deal additional charge, which can conveniently consume the benefits of the card. Many cards charge around 2% for purchases made in various other money. Various other cards bill as much as 2.5%. Consequently, it's ideal to prevent making acquisitions in foreign currency with a Thai credit card.

Royal Orchid Plus

The Citibank Royal Orchid Plus bank card is just one of the most popular credit cards in Thailand. This card uses a wide variety of rewards and also opportunities to its individuals. In addition to frequent flyer miles and also exclusive shopping privileges, the card also provides incentives for taking a trip on partner airlines, such as Thai Airways. Because of this, the Royal Orchid Plus is a prominent option for vacationers in Thailand.

You can move the factors and also miles that you make from other commitment programs to your Royal Orchid Plus account. For example, you can transfer a certain variety of Marriott indicate your Royal Orchid And also account and also receive a reward of 5,000 miles. Nonetheless, you need to know that your miles are not redeemable on Celebrity Partnership trips or for hotel keeps. You can, however, transfer the miles you've gained from your Citi card to the Royal Orchid Plus.

To obtain the best benefits from the Royal Orchid And also credit card in Thailand, you have to be a THAI American Express Platinum participant. By doing so, you can obtain open door to the Wonder Lounges. Furthermore, when you utilize the Card, you will certainly gain 1.5 Thai American Express Platinum factors, which can be transformed to one-Royal Orchid Plus mile. All you have to do is call the Amex telephone call facility and also notify the policeman that you intend to retrieve the miles. Then, your miles will be attributed to your account in 3 working days.