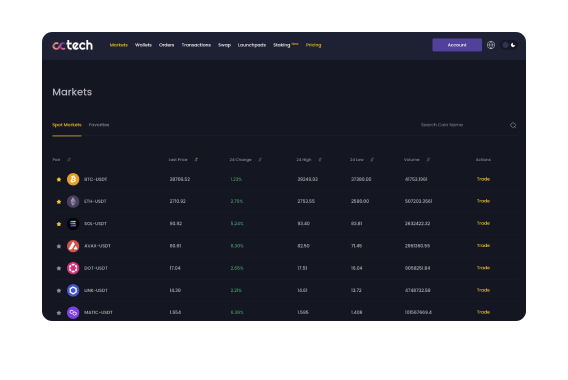

CCTech Smart Solutions, LLC has revolutionary Cryptocurrency Exchange Software. The fastest white-label market-leading solution. You can start your own cryptocurrency exchange business with white label Cryptocurrency Exchange Script. It’s fast, secure, 100% fully tested source code and it is guaranteed! You will have your own cryptocurrency exchange which supports trading of Bitcoin, Ethereum, altcoins, and other cryptocurrencies. CCTech offers you the cryptocurrency exchange product with all the essential features you need to create a safe and secured open-source trading platform. It’s smart to begin your white label cryptocurrency exchange platform as it’s secure, cost-effective, and provides immediate deployment with innovative features, benefits, and security options. Their cryptocurrency exchange software is built for faster deployment, high performance, extreme scalability, and extensive white-label customizations. It offers a full-stack solution that enables exchange operators to build lucrative revenue streams easily. Who is their cryptocurrency exchange software for? It is designed for the business owners who want to open their own trading platform; for the coin owners who plan to list custom tokens and raise the funds from ICO; for the professional traders who want to run trading bots and arbitrage businesses; or even for crypto entrepreneurs who just dream of opening their own crypto exchange platform. If you are one of the above-mentioned individuals or organizations, then you are in the right place! Visit the CCTech Smart Solutions website at https://cryptocurrency-exchange.software to see a free demo today. You will be happy that you did!

Now that you know more about CCTech Smart Solutions and their Cryptocurrency Exchange Software, let’s talk about what a cryptocurrency exchange is. If you've been wondering what is a cryptocurrency exchange, you're not alone. There are many types of exchanges, and understanding which one is right for you is the first step to purchasing cryptocurrency. To purchase cryptocurrency, you must first sign up for an account, which can be done through your bank, credit card, or debit card. Most exchanges will also request KYC information, such as your name, home address, cryptocurrency exchange software and mobile phone number. Then, you will be able to buy and trade cryptocurrency.

A crypto exchange should have enough trading volume to keep your funds secure. That way, you can sell your holdings whenever you want to. A popular exchange will likely have the largest trade volume, although you might get better service with a smaller exchange. Moreover, you'll want to check the exchange's customer service. You can contact a live representative if you have any questions. The customer service department should be available round the clock to help you make a decision. There's nothing worse than being stuck in the middle of a trade and wondering what to do next.

Regardless of the type of exchange you choose, it's important to note the differences between centralized and decentralized platforms. While these may seem similar, they're completely different. To get a full picture of what makes a cryptocurrency exchange, consider its features, customer service, and technology stack. The more comprehensive the exchange, the more important it is to keep the platform secure and reliable. This means that the exchange should be scalable and powerful, with an active community of developers.

Before choosing a cryptocurrency exchange, consider the fees. Generally, the easier the exchange is to use, the higher the fees. However, you may find that the higher fees are worth it if the exchange offers additional security or insurance. If you're new to the world of crypto, consider a fee for ease of use and peace of mind. There's no need to spend your money if you can't understand the terms and conditions.

While the majority of cryptocurrency exchanges are centralized, there are decentralized exchanges as well. Decentralized exchanges are similar to centralized exchanges, but remove the custodial element. This gives the buyers and sellers control of their wallets and avoids third-party money management. They match buyers and sellers and transfer funds directly between the two parties. It's a win-win situation for both parties. This article explores the differences between centralized and decentralized exchanges.

Most crypto exchanges offer a range of digital currencies and tokens. Some leading exchanges will even hold your private keys in cold storage. These exchanges provide a safe and secure environment for your cryptos, though the main concern with these exchanges is whether hackers can hack their servers and steal your private keys. There are ways to avoid these issues with a cryptocurrency exchange, and the best option is to choose a site with strict security measures.

In the U.S., there are regulated cryptocurrency exchanges. Some are not allowed to operate in all states. This is because they must abide by U.S. crypto laws. However, you should check with your local regulator to find out which one is right for you. If you're wondering what cryptocurrency exchanges are, you should learn more about the different types available to you and start looking for one. It's worth the extra effort to research the different types of exchanges.

The main difference between a traditional financial exchange and a cryptocurrency exchange is that these platforms match buyers with sellers and vice versa. This means that they are considered leading indicators for the value of cryptocurrency and how well they perform. Because of this, they provide some of the most competitive rates for trade. This means that cryptocurrency exchanges are essential for the continued growth of the cryptocurrency market. The following are some tips to get started. A good exchange will be easy to use and understand.

A cryptocurrency exchange is a marketplace that allows users to trade crypto with regular currency. Traders use these exchanges to purchase cryptocurrencies and sell them for fiat money. The prices of these cryptocurrencies fluctuate, and the exchange's price will depend on the volume of buying and selling activity. There are no central authorities overseeing these exchanges, and the industry is growing quickly. If you're interested in investing in cryptocurrency, a cryptocurrency exchange may be right for you. Now that you know more about cryptocurrency exchanges, it is time to go back to the website of CCTech Smart Solutions to see the demo on their cryptocurrency exchange software.