Auditing managerial compliance can feel like trying to solve a Rubik\'s Cube blindfolded. However, with the right approach and tools, you can unravel the complexities involved and ensure your organization runs smoothly. This article will guide you through conducting a thorough audit of managerial compliance.

Understanding Managerial Compliance

Managerial compliance refers to how well managers adhere to established laws, regulations, and internal policies. It is vital for maintaining organizational integrity and avoiding legal pitfalls. Think of it as a safety net that protects your business from falling into chaos.

Why Audit Managerial Compliance?

Auditing managerial compliance isn’t just about checking boxes. It helps identify areas where managers might need more support or training. The goal is to promote accountability and enhance overall performance within the organization.

Steps to Conducting an Effective Audit

Define the Scope- Identify what areas you want to focus on during the audit. This could range from financial compliance to adherence to HR policies.

- Collect all necessary documents such as manuals, reports, and past audit findings. These will serve as your roadmap.

- Draft a plan that outlines how you will conduct the audit. Include timelines, responsible parties, and key milestones.

- Communicate with all involved parties early on. Getting their buy-in is crucial for smooth sailing throughout the audit process.

- Speak with managers to understand their perspectives on compliance issues they face daily. Ask open-ended questions—this isn’t an interrogation; it’s a conversation!

- Examine existing processes and procedures for any gaps or inconsistencies in compliance measures.

- Use available data to spot trends or recurring issues that require attention.

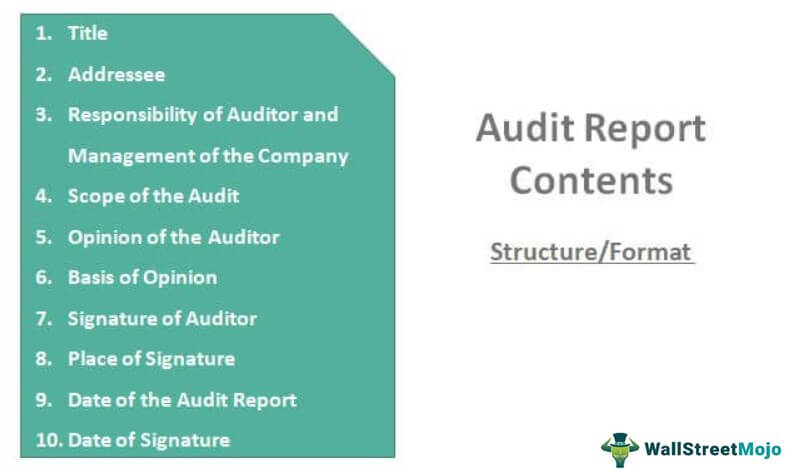

- Summarize your findings concisely in a report format that highlights strengths and weaknesses in managerial compliance.

- Offer actionable recommendations based on your analysis for improvement.

- Schedule follow-up audits to ensure that recommended changes have been implemented effectively.

Research Insights

According to a study by the Institute of Internal Auditors (IIA), organizations that regularly perform audits are 50% more likely to stay compliant with regulations than those that don’t engage in formal auditing practices. This statistic underscores the importance of having a strong auditing framework in place.

auditFrequently Asked Questions (FAQs)

Q1: How often should we conduct audits of managerial compliance?

A1: Ideally, audits should be conducted at least annually; however, semi-annual or quarterly reviews can be beneficial depending on your organization's size and complexity.

Q2: What should I do if I find non-compliance issues?

A2: Document everything clearly and communicate your findings with management promptly while homepage providing practical solutions for rectification.

Q3: Who should be involved in the audit process?

A3: Involve not only management but also employees at various levels who can provide insights into operational challenges related audit to compliance.

Q4: Can external auditors help with our internal audits?

Conclusion

Conducting a thorough audit of managerial compliance doesn't have to be overwhelming. With clear steps and proper planning, you can navigate this process confidently and effectively contribute to your organization's success. Remember, every step taken towards better compliance is one step closer towards building a solid foundation for future growth!

So put on your auditing hat, gather your materials, and get ready to dive into this essential task! After all, keeping things compliant is like keeping your house tidy—nobody wants chaos lurking under the couch!