The Main Principles Of Welcome To The State Of Wisconsin Compensation Plan

However, cash from a certified strategy can be rolled over. Please check the strategy guidelines that use to you with your plan's administrators and speak with a tax consultant prior to taking any in-service withdrawals.

The State of Wisconsin produces and preserves a payment strategy to accompany each spending plan cycle. This file is described as the State of Wisconsin Settlement Strategy and it explains how pay is developed, and preserved, for many functions across the enterprise. The 2021-2023 Compensation Strategy was authorized by JCOER on December 22, 2021 in addition to the trades contracts negotiated by the State, the University of Wisconsin System, and the University of Wisconsin - Madison.

Little Known Questions About Bonus Offer.

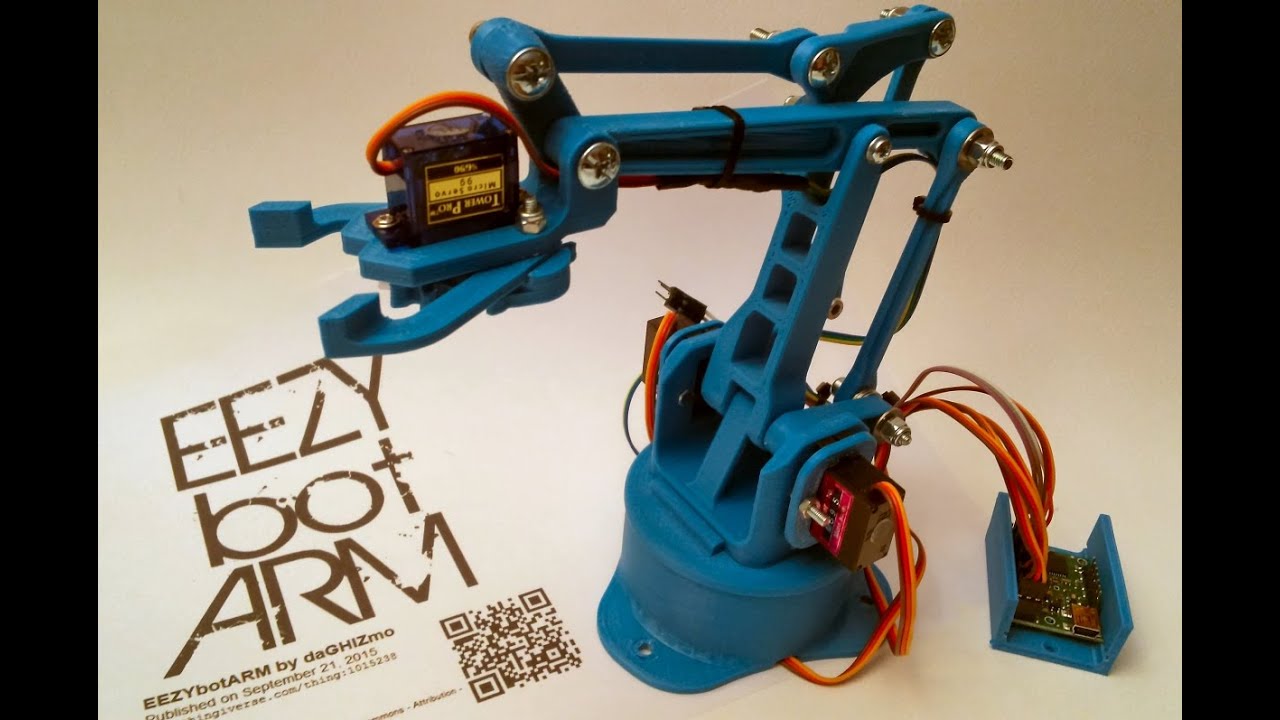

eazybot trading

eazybot trading

Market and Parity Provisions.

Deferred payment, As a UW worker, you're eligible to take part in Washington state's Deferred Settlement Program (DCP), a retirement plan that provides you another chance to optimize your tax-advantaged cost savings. Newly worked with full-time employees * will be immediately enrolled in DCP 3 months after their hire date.

An Unbiased View of 457(b) Deferred Compensation Plan Faq - City Of Fort ...

Your contribution are made pre-tax and you get to select your investment funds from the Washington State Investment Board's menu of alternatives. Your investments grow tax free till you're ready to withdraw them at retirement. Because DCP is a voluntary savings program, you can start, stop, or change your contributions at any time.

For instance, a contribution rate change on January 5 will work for the January 16 through January 31 pay period. This pay period is paid on February 10, which is where you will see your brand-new contribution rate. You can use the DCP in addition to both your obligatory UW retirement strategy and the UW Voluntary Investment Program (VIP), if you're enrolled.

The Single Strategy To Use For Deferred Compensation Program - The City Of Portland, Oregon

eazybot reviews

eazybot reviews

So think about enrolling in the DCP if you desire yet another choice for constructing your tax-advantaged retirement savings. Learn more and enlist The DCP belongs to the Washington State Department of Retirement Systems. Visit their website to learn more about how DCP works consisting of the financial investment options offered and the yearly contribution limitations.

Government Departments A-H Human Resources Person Resources Staff Member Advantages FAQ

Some Known Details About Compensation Plan - Dea(local)-b1 - Mission Cisd

eazybot reviews

eazybot reviews

Deferred Compensation Program The Deferred Payment Plan is a voluntary retirement savings prepare offered to eligible City of Portland staff members. The plan allows you to conserve for retirement on a tax-deferred basis, and is intended to function as a supplement to the City's retirement benefits. Deferred Compensation is enabled and managed under Internal Revenue Code Area 457 for public staff members.

Create your free Eazy, Bot account-Eazy, Bot connects straight to 5 exchanges! -100% of your capital is traded-Proven Ai trading bot produces avg 10% plus monthly-20 level recommendation program-No referring required-Auto compound profits-US friendly exchanges available1. Free Variation: Trade 2 pairs on 1 exchange2. Beginner: $250 Yearly, as much as 10 Pairs on 2 exchanges3.