MCCA’s finance products stand apart from other options open to Australian Muslims. When it comes to making our community’s dreams come true, MCCA has a strong track record in delivering excellence. Thank you Insaaf and team for helping me sorting out my vehicle finance. I live in interstate and I had all the communication with them either over the phone or via email. I faced no difficulty dealing with Insaaf and the financing process was very smooth. This course provides a detailed background on the religious foundations, history, and political economy of the emergence of modern Islamic Banking, as well as introducing basic ideas and common products in Islamic Finance.

Published by leading South East Asian law firm, Zaid Ibrahim & Co, with headquarters in Malaysia, the booklet aims to dispel the misconceptions which have built up around Islamic finance in some parts of our society. There are, however, some lingering negative attitudes in the community and that is why I was pleased to launch last month the Demystifying Islamic Finance booklet. There is no doubt there is a growing awareness – both in the community and also among policy makers – of the potential of Islamic finance here in Australia.

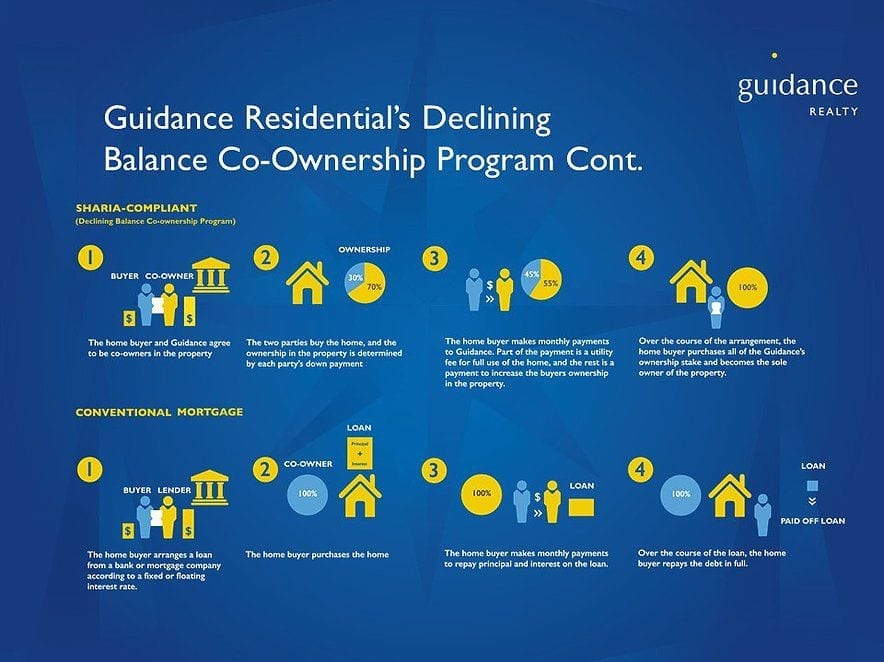

The way it works is that the financial institution mortgages the property and charges you an amount that you pay in rent. The more funds you repay, the more ownership you have in the property until it is paid off in full. Keep in mind that just because the institution doesn’t charge interest, doesn’t mean it doesn't charge a profit. The financial institution still makes a profit from leasing the property to you. The providers of this style of finance all operate under the National Consumer Credit Protection Act and will make independent enquiries into your ability to meet the financial commitments without undue hardship. This often means Islamic finance comes in the form of a “ full doc” application process.

We value our editorial independence and follow editorial guidelines. I’m afraid we may not be able to provide you with an answer to that question. The accounting treatment will be determined by the lender/bank that offers the Islamic Home Loan. Belinda Punshon worked for Finder as a writer on home loans and property and as a corporate communications executive. She has a Masters in Advertising, Public Relations and Journalism from the University of New South Wales and a Bachelors in Business from the University of Technology Sydney.

Over time, the client pays off the house through rental payments, which include a profit to the financier and reflect market interest rates. Eventually, the asset is wholly paid off by the client and they own the house outright. The bank has legal claims to the home, and can repossess and force you to sell it if you default on your loan. The bank or financing company makes its profit through the interest and fees. Our consultants are here to help you purchase your next property, vehicle or business asset without entering into an interest-based mortgage.

ANU utilises MyTimetable to enable students to view the timetable for their enrolled courses, browse, then self-allocate to small teaching activities / tutorials so they can better plan their time. If you have been offered a Commonwealth supported place, your fees are set by the Australian Government for each course. More information about your student contribution amount for each course at Fees. To date, Victoria is the only state to recognise the potential for Islamic finance contracts to incur double stamp duty, introducing legislative exemptions in 2004. “One of the great challenges in starting Australia’s first Islamic bank is that you have all of these jurisdictional and legislative challenges that you don’t have when you’re running a conventional bank,” Mr Gillespie said.

“There are developers that we work with that in the past just haven’t used any bank finance so we deliver projects with 100 per cent of their own equity,” said managing director Amen Zoabi. “Interest-free banking was non-existent in Australia, but it did exist in Canada where I had previously been studying,” he said. When Professor Ishaq Bhatti came to Australia 30 years ago, the bank teller looked bemused when he asked for a savings account that didn’t accrue interest. Under Islamic law, or Sharia, there is a prohibition on charging or paying interest, which is called riba and considered exploitative because the lender does not assume a share of the risk.

Saving People from Riba

When Professor Ishaq Bhatti came to Australia 30 years ago, the bank teller looked bemused when he asked for a savings account that didn’t accrue interest. Under Islamic law, or Sharia, there is a prohibition on charging or paying interest, which is called riba and considered exploitative because the lender does not assume a share of the risk. When Professor Ishaq Bhatti moved to Australia to do his PhD in 1987 he went to the bank and explained he was a Muslim and needed a savings account that didn’t accrue interest. Speaking to The Adviser on the occasion of the RADI being granted, Islamic Bank Australia chief executive Dean Gillespie outlined that the bank will look to distribute home finance through the broker channel, as well as direct.

Islamic Bank Australia just happens to be the first one in Australia. Dr Imran Lum, Director Islamic Finance in NAB’s Deal Structuring and Execution team said; “We’re really proud to be able to offer such a valuable service to Australia’s Muslim community. "People could pay their bills with us, withdraw at ATMs, have savings with us on a profit-share basis, not interest based."

"As I have indicated, Australia is committed to ensuring we can accommodate Shariah-compliant finance, banking, insurance and other financial services products within our tax, regulatory and prudential codes," said the Assistant Treasurer. Islamic finance is a growing sector of the global finance industry with a year-on-year growth rate averaging more than 15%. The global demand for sharia-compliant products is on the rise and there has been a flurry of Islamic start-ups (from full-service investment banks to specialist advisory firms). While Islamic Bank Australia is not currently open for business, Halal Car Finance Australia it plans to eventually offer a full suite of retail and business banking services in Australia. Australia's Islamic bank offering Shariah-compliant banking services including everyday banking, savings products and home finance.

We’ve taken the mortgage from them, and secured a transaction agreement that doesn’t express principal or interest. 'Sponsored', 'Hot deal' and 'Featured Product' labels denote products where the provider has paid to advertise more prominently. Just like any other everyday account, you’ll have the option to have physical and digital cards.

While there are several foreign banks in Australia, including the Arab Bank and HSBC, few of them offer Islamic home loans. However, Westpac and National Australia Bank have introduced Sharia-compliant products to the market. Mozo provides factual information in relation to financial products.

Depending on the financial institution, Islamic home loans may be slightly more expensive than non-Islamic home loans. However, this will depend on how the financial institution determines the profit made on the sale. Although, technically, interest isn’t charged for an Islamic home loan, the financial institution will still be charging fees in the form of rent or profit rate. Make sure you have a clear understanding of exactly how much extra you’re being charged as a result of the profit rate. Murphy stresses that when comparing Islamic home loans, you should keep an eye out for the service level offered by the provider. “Ours is a common mortgage transaction that’s fully functional.

With its current APRA restricted licence, Islamic Bank Australia can only have a limited number of customers in 2023. The bank hopes to obtain APRA approval to offer its products to the general public by 2024. Initially, Islamic Bank Australia will offer everyday accounts, term deposits and home loans. The Islamic Bank Australia will offer banking services that are compliant with Sharia Law to a small number of customers starting in 2023.

With a 30+ year track record, we provide a compelling Islamic finance option for the Muslims of Australia.

Our goal at Mozo is to help you make smart financial decisions and our award-winning comparison tools and services are provided free of charge. Instead of the typical interest earning products, Islamic Bank Australia will offer a lease-to-buy model for home loans and a profit pool for term deposits. And at the big end of town, one of the country's largest banks, NAB, is launching a specialised financing product for Islamic business customers, which the company believes is an Australian first for banking. To help them become an ADI, Hejaz have appointed three new staff to their leadership team. Andrew Oey, once of Bank of Melbourne and Bankwest, will join as head of lending, with experienced insurance and financial services operator Samrah Sahi coming on board as head of customer service.

Australias 1st Islamic bank will distribute through brokers

The typical Australian home loan earns a certain amount of interest annually. That interest is the profit the financial institution makes when you borrow its money. Sharia Law offers Muslims a broad set of rules for living an ethical life.

That’s because the total cost depends very much on lender fees and how much they charge for borrowing – whether that’s through an interest rate, a rental