The consultation meetings were attended by representatives from taxation professional bodies, major law and accounting firms, various major corporations and business associations. Open your account instantly through the app anywhere across Australia. Transfer funds between banks in real-time using the New Payments Platform . Binah who specialise in delivering full scale construction services have utilised NAB’s new Islamic financing product on their latest development.

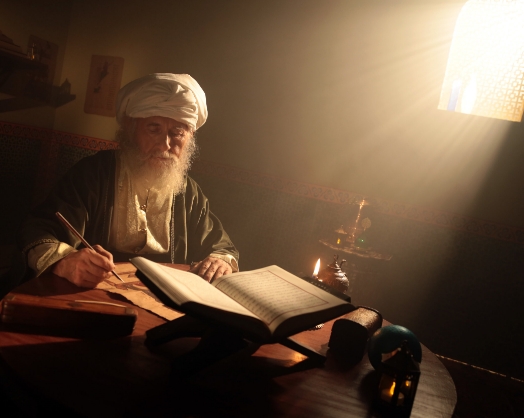

The term ‘Islamic Banking’ is a constituent of ‘Islamic Finance’ and refers to the set of banking and financial rules and practices organized on a basis that excludes interest as a determinant in financial lending and borrowing transactions. The conceptual basis of interest-free banking is to be found in Islamic tenets or Shari’ah. The latter encourages Islamic Bank In Australia the practice of ‘Profit/Loss Sharing’ as opposed to interest .

While the bank is not yet open for business , it has said it will offer a full suite of shariah-compliant retail and business banking services. And at the big end of town, one of the country's largest banks, NAB, is launching a specialised financing product for Islamic business customers, which the company believes is an Australian first for banking. If you wish to compare your Islamic home loans, in the above section “Are there any Islamic banking institutions in Australia? ” you’ll find list brokers and providers that specialise in Islamic home loans. ” you’ll find list brokers and providers that specialize in Islamic home loans.

Our experienced consultants can help your business reach new heights by offering Ijarah lease agreements to enable your business to acquire or lease assets such as motor vehicles, trucks, plant equipment, machinery & more. Find out the latest insights about Islamic finance and investments. Be part of a 4000+ member strong community that finances projects and ambitions through Islamic contracts. Find out the latest insights about super, finance and investments. We congratulate you for making the right choice and selecting the halal home loan alternative. Once you have completed and submitted this form, a dedicated MCCA sales executive will contact you within 1 business day to walk you through the next stage of your application.

But after the couple married in 2018, they started using an Islamic financing company to buy property. Like many Australians, Melike got her first bank account through Commonwealth Bank's Dollarmites program as a child and she still banks with the institution. With roughly 600,000 people identifying as Muslim in Australia, industry reports place the potential size of this market in Australia at $250 billion. I have been with Amanah since March 2019 and so far, their service has been superb from the beginning. Even during challenging times like today their post-settlement team are willing to help.

Australias first Islamic Bank set to open soon

Hejaz wouldn’t exist if it wasn’t for Halal so it is our duty to provide you with authentic Sharia-compliant financial products and services. You will also get an insight into how Islamic financial institutions use the principal contracts to service a wide variety of client requirements, across financing personal and business needs. If you open a savings account with us, we’ll use your funds in ethical income-generating activities, and then share these profits with you. It’s a totally new way to think about banking,” explained Mr Gillespie. We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here.

Islamic home loans enable you to finance your property purchase with a different financial product that doesn't accrue interest in quite the same way. However, Australia’s credit laws still apply and the lender will still charge you for borrowing money. On 13 October 2010, the Board of Taxation released itsdiscussion paper on the reviewof the taxation treatment of Islamic finance, banking and insurance products.

Moreover, before you apply for a specific loan, please make sure that you’ve read the relevant T&Cs or PDS of the loan products. You can also check the eligibility requirements to determine whether the product is right for you or not. The financial institution makes money by charging a profit rate on your rental instalments. In most cases, you are offered the same features as a typical home loan. Some of these help you in achieving property ownership sooner, while others can give you the option of lower payments if you make lease payments only.

With a 30+ year track record, we provide a compelling Islamic finance option for the Muslims of Australia.

It’ll have no account keeping fees, and you can withdraw and deposit money using ATMs available in Australia. According to Islamic Bank Australia, rent is only charged on the proportion of the property you don’t own. This means your rent should go down over time, and eventually you’ll have full ownership of the house. To follow Sharia Law, Islamic Bank Australia will follow a lease-to-buy/co-ownership model that Sharia Compliant Loans Australia acts like paying a monthly rent until you pay off the equivalent of the property’s original price. There are hundreds of deposit-taking banks around the world that are Sharia-compliant.

“Our proposition is a segment-based proposition for Muslim Australians. We’re not just designing a digital experience; they’re fundamentally different products,” Mr Gillespie said. Then instead of having mortgage repayments, you’ll be paying rent as if leased. The cost will include the rental amount plus payment towards buying the bank’s ownership of the property.

The Chairman of the Board of Taxation announced the release of the discussion paper viaa press release. The Board has developed this discussion paper to facilitate stakeholder consultation. None of the Islamic financing companies currently offering consumer finance products in Australia are licensed as fully fledged banks. That means that while they can offer home loans or super, they can't take deposits from customers. Hejaz Financial Services, one of the leading providers of Islamic finance in Australia, is Islamic Bank Loans set to apply for a banking licence to become an authorised deposit taking institution .

Australias 1st Islamic bank will distribute through brokers

In essence, Islamic home loans afford homebuyers everything that traditional Australian mortgages do, but they adhere Halal Car Finance Australia strictly to Sharia law. Islamic home loans are designed to be as cost-effective, transparent, and practical as any other form of finance, and you can compare the cost of Islamic home loans easily online, just like with traditional Australian mortgages. In a first for Australian banking, NAB has today announced the launch of a specialised financing product for Islamic business customers looking to invest and grow. When considering an Islamic home you will need to think carefully about what you can afford.

Generally, it’s not possible in Australia to provide a fixed rental for the entire term of a mortgage. Melbourne-based investment advisory firm Hejaz Financial Services has also applied for a banking licence after seeing huge demand for its sharia-compliant finance, mortgages and superannuation since 2013. And at least two entities are seeking a licence to establish Islamic banks in Australia, alongside non-bank financial institutions that already offer sharia-compliant services. Islamic Bank Australia (islamicbank.au) will be the first Australian bank to offer a full suite of retail and business banking services – all without interest and Shariah-compliant for the first time in Australia.

Find out the latest insights about Islamic finance and investments. Be part of a 4000+ member strong community that finances projects and ambitions through Islamic contracts. We provide tools so you can sort and filter these lists to highlight features that matter to you. Belinda Punshon worked for Finder as a writer on home loans and property and as a corporate communications executive. She has a Masters in Advertising, Public Relations and Journalism from the University of New South Wales and a Bachelors in Business from the University of Technology Sydney. Your lending institution may approve your circumstance beforehand, allowing you to immediately choose a home that is within the price range Islamic Home Finance Australia they agreed upon, thereby facilitating your application process.

Get The Word Out will make reasonable efforts to correct any error of fact brought to its attention. The granting of the licence means that Islamic Bank Australia has become the first Australian bank for Islamic borrowers. Insaaf has all the tools to help your business grow financially and Shariah complied. We work with you to create highly effective financial strategies to achieve your lifestyle and wealth creation goals in accordance with your faith and beliefs. For more business news and analysis, visit NAB’s Business Research and Insights.

“With the number of Muslims in Australia growing by more than 6 per cent every year, we’re excited to be bringing this new type of banking to the Australian community,” said Islamic Bank Australia CEO Dean Gillespie. Fixed cost development, licensing and hosting fees for the use of financial calculators, key fact sheets and research. Islamic law says that interest can’t be charged or paid on any financial transaction. Mr Gillespie also said that Islamic banks were inherently ethical, refusing to deal with certain industries. “With the number of Muslims in Australia growing by more than 6% every year, we’re