During this shaky economy, it is very necessary to learn how to budget so that you won't go bankrupt. Budgeting would also include summer vacations. Despite having a vacation, it is not an excuse for you to spend a lot of money. It would be best to plan ahead of time and have a definite budget so that you will not be spending beyond your budget.

When you read Budgeting Tips online, you will often read stories of people who have been paying on their credit accounts for year and years, never making any progress. Because of compounded interest, that is true. So, your first goal should be to start paying off more on the ones that have the higher interest. Never pay the minimum amount, or the balance will quite simply never go down.

Consider this, if you spend $15 a day between your breakfast and lunch (which let's face it, is probably a low ball figure) you are going to wind up spending $75 per week just on food alone. If you were to project that over the year, you are looking at spending close to $4000 on food at the office. And that's not even counting dinner. Could you use an extra $4000 to be put towards something else in your life.

As soon as we tell ourselves that we're going to be watching and restricting our spending it immediately brings up an inner desire to rebel. We want what we want when we want it!

Bad habit two: 'robbing Peter to pay Paul' -- this is using debt to pay debt. You are likely to be paying fees to do this and all you really are doing is shuffling money about.

Clip coupons. This is very helpful if you buy name brands. The Sunday newspaper is usually chock full of great coupons. Organize your coupons in accordance with your shopping list. Many times grocery stores will also have VIP clubs where you can get a discount on certain items. Sometimes I will shop as many of those items as I can on any given shopping day. I have saved a lot of money that way, over the weeks and months.

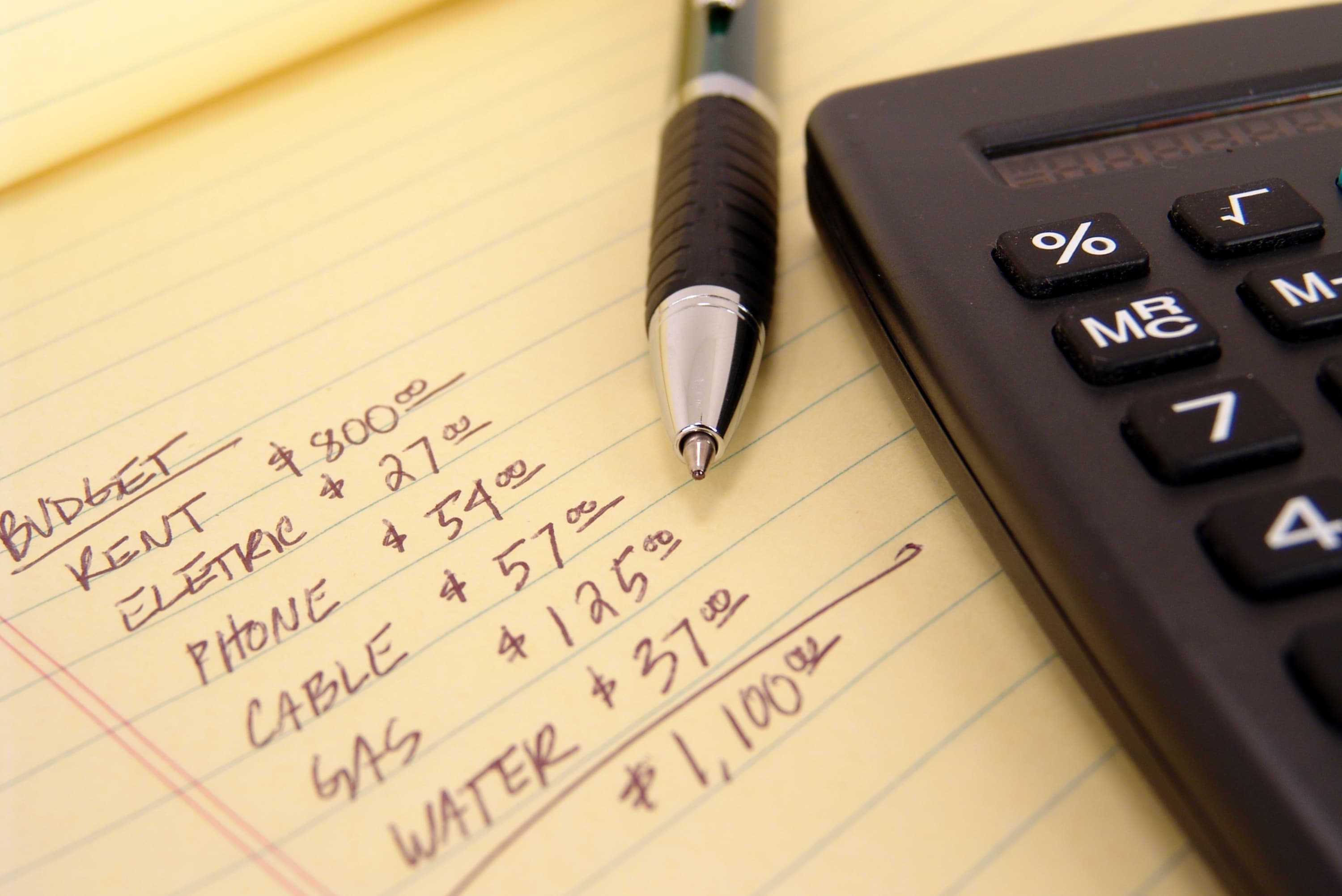

Also, once you have created the budget, continue to keep it simple. Don't add 300 buying categories to the sheet. When you only use maybe 20 to 30 categories tops. Unless there is a good reason to track beauty products separately (maybe you think you are overspending in this planning finances category) then just lump it in with your grocery category. Or Pharmacy category. No need to break it out unless you really need to track that expenditure at a deeper level.

Budgeting can be a frustrating task sometimes. You don't get to be as spontaneous and do things that may come up at the spur of the moment. However, if you plan correctly and utilize some of these techniques you will be surprised at the amount of money you can save.