How to Become an Actuary: Degree Requirements & Certification Exams

The general path, as mentioned earlier, is to complete an undergraduate degree and then start your actuary certification process with one of the two professional bodies in the us, soa or cas.

However, there is no requirement to complete your undergrad before starting the certification exams. Take the first actuarial exam as soon as possible, whether you’re in school or not. This will demonstrate your aptitude for the type of math and other skills required on the job and show recruiters you are serious about your commitment to the industry.

Becoming and maintaining the enrolled actuary designation requires significant effort and skill. The requirements are as follows:

qualifying formal education – a bachelor’s degree where the primary area of study is actuarial mathematics or an equivalent number of hours in studying mathematics, statistics, actuarial science and other representative subjects. Examination – a candidate must successfully complete a series of examinations to demonstrate pension actuarial knowledge. For practitioners working towards the enrolled actuary designation, this tends to be the most difficult requirement. The exams require extensive study and are extremely difficult to complete. In many cases, pension practitioners with years of experience are unable to pass the required exams.

To work as an actuary, you'll need a bachelor's degree as well as certification through a series of exams. If you're still in high school, you can start preparing for your actuary degree and career by enrolling in a college prep curriculum. Take math classes every year, if possible to include advanced placement (ap) classes and courses such as statistics and calculus. Take computer science classes to build your computer skills. Some colleges and universities offer actuarial summer programs for minority high school students to boost their chances for success in the field.

Next, how to become an actuary is the discipline that they undertake. Here are some training criteria that they follow:

three basic requirements- education, experience, and completion of the relevant exams

good hold on mathematics, algebra, and calculus during high school

understanding of economics, business administration, commerce, and computers

should have a graduate degree in economics or business administration or commerce or mathematics.

October 13, 2019 career options 60 views

making plans to become an actuary? good for you. However, before you continue on with those plans, do two things. Get a calendar and mark off the next six to ten years of your life, and make sure you look in the mirror and tell yourself over and over again that you really do love mathematics and/or have math skills as well as an interest in finance. Oh, sorry folks; almost forgot to mention that a bachelor’s degree, certifications, and some on-the-job training are usually some of the more common requirements for this type of career. Well, if this first paragraph hasn’t scared you off, and you’re still determined, remember that when all the blue Gift for Actuary skies and green lights come back and you have a nice job at some large insurance company making a bucketful of those green pieces of paper with the picture of dead president on the front…. You’ll be happy and glad you chose to become a full-pledged actuary! we’re proud of you.

There is a long series of exams, that takes several years to complete, that is required for certification as a professional actuary. The examination requirements and professional designations differ from country to country but are all similar in the depth and rigor of study required. Here is an outline of the process for those studying to become actuaries in the united states.

An actuary must have a bachelor's degree, whether in mathematics, actuarial science, statistics or a similar field. Coursework typically includes economics, corporate finances and applied statistics. There are a series of exams that you must pass to become an actuary, a process that can take six to 10 years. However, you can start working as an actuarial assistant after you pass the first two exams. The casualty actuarial society and the society of actuaries both sponsor educational programs that lead to certification. They also provide fellowship certification in certain actuarial niches and offer continuing education, which is required to maintain certification.

Why Become an Actuary?

Although qualifying as an actuary is a demanding process, you can expect to be well rewarded for your efforts. Starting salaries are well above other industries, with student actuaries earning an average basic salary of around £35,000. This can rise to around £50,000 for newly qualified actuaries, while senior actuaries can earn over £200,000.

Tweets by @beanactuary.

What does an actuary do? what is their job description? who hires actuaries? what types of actuarial jobs are available? how much do actuaries make? what are actuarial exams?

these are the frequently asked questions many college students ask when considering an actuarial science major. In this video, we discuss some of the traditional actuarial jobs, and highlight other industries that have begun to hire actuaries.

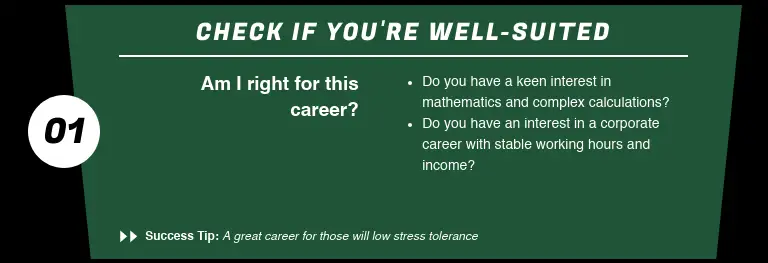

An actuary is essentially an analyst for risk management, doing the math to figure out how risky something might be and determining how best to minimize it in the future. Actuaries are most often needed in the insurance industry where there is a lot of financial risk involved in health insurance, life insurance and home insurance. Here, actuaries use data and a number of factors to determine just how risky an insurance policy is to give to someone.

Even in insurance, the actuary's traditional home, it is becoming more common for actuaries to work in non-traditional roles and contribute to other areas of the business. For example, in some firms actuaries are modeling the sales and distribution process to identify the characteristics of the most effective agents in particular geographies, innovating in the use of big data produced by telematics devices in vehicles, or contributing to the claims process by doing a claim-by-claim analysis to identify which claims have risks of exceeding the expected payment. Most insurers also have actuaries embedded in product management, claims, and individual global risk underwriting.

As children, the question we’re most often asked is: ‘what do you want to be when you grow up?’

prodded by our proud parents and inspired by our own vivid imaginations, the answers we came up with, almost felt automatic: doctor! lawyer!firefighter! but you’ve probably never heard a child say: ‘i want to be an actuary!’ which is a shame, really, considering it’s one of the highest-paying and top-ranking jobs in the world.

The daily job duties which an actuary must complete are quite vast and varied. This individual wears many hats and must be adept with completing various tasks on a daily basis. Although many individuals may be unaware of the responsibilities which an actuary takes on in their job role, the position of actuary is one of an important nature.

What is an Actuary?

if you’re thinking about becoming an actuary in your 30s, 40s, or 50s, you might be wondering if you’ve missed your opportunity. Are you too old? is it too late?

the good news is that you’re definitely not too old nor too late. Lots of people have done this before and managed to successfully switch to the actuarial career.

Alternate job titles: actuarial analyst i | associate actuary | entry actuary | entry level.

An important part of an actuary's professional development involves advancing through a series of exams offered by the casualty actuarial society (cas). As an actuarial assistant, you will receive support throughout your career as an actuary, including:

up to 115 paid study hours per exam

opportunities to take review courses

on–site quiet rooms for studying.

What kind of training is required to become an actuary?

to become an actuary, you must have at least a bachelor’s degree. Many colleges and universities offer actuarial sciences programs that blend business, mathematics, and statistics coursework. You do not have to major in actuarial sciences to become an actuary, but you should choose courses that will build a strong foundation in calculus, statistics, probability, economics, finance, management, and computer science. College is a great time to pursue internships that will give you the opportunity to apply this broad base of knowledge in an actuarial position. Your internship may lead to a job offer after graduation, but at the very least, you will make professional contacts in the field.

If you have shown an interest in the field of actuary science, it is a sure bet you have begun to consider which of the best actuarial science schools or top actuarial science colleges may offer an accredited, proven program that meets your education and career objectives. As you begin your search for the best actuarial schools nearby or investigate some of the top actuarial