At Breathe Freely Insurance coverage, we can assist you discover the very best possible rates on non-owner car insurance policy to conserve you the optimum quantity of cash. For a complimentary quote on non-owner protection as well as SR22 from Breathe Freely Insurance policy, request a quote online or call us today at 833 (division of motor vehicles). 786.0237 (insure).

SR-22 Insurance can only be acquired via an insurance coverage provider (insurance coverage). SR-22 insurance has a significant influence on your rates in The golden state, and those rates can differ substantially from one business to an additional. Restrictions for An SR-22 Insurance Policy in The golden state At the minimum, you require the protection listed here if you are required to have SR-22 insurance in California (credit score).

The very same instance relates to those that do not have an automobile. no-fault insurance. Non-owner cars and truck insurance coverage is the suitable alternative for those that do not own an auto considering that common vehicle insurance policy can be expensive. sr22. That indicates that such people will be covered in the occasion of an additional crash, and they can additionally reveal proof of responsibility insurance protection to obtain their certificate restored. insurance.

The reason that non-owner SR-22 insurance is cheaper is that the insurance provider assumes that you do not drive usually, and also the only insurance coverage you get, in this situation, is for responsibility only - sr22 insurance. If you rent out or borrow vehicles regularly, you must consider non-owner automobile insurance policy also (insurance). Prices can differ across insurance companies, the typical annual price for non-owner automobile insurance policy in The golden state stands at $932.

Some Known Incorrect Statements About Get Sr22 Insurance In Washington State Financial ...

Demands for An SR-22 in California First, understand that an SR-22 impacts your cars and truck insurance coverage cost and also insurance coverage (insurance companies). As an example, after a DUI conviction in California, common drivers pay a standard of 166% more than cars and truck insurance coverage for SR-22 insurance policy. department of motor vehicles. The minimal duration for having an SR-22 in The golden state is three years, but one may require it longer than that, depending on their case as well as crime.

In any one of these situations, an SR-26 form can be submitted by your insurance provider. When that occurs, your insurance firm needs to suggest that you no longer have insurance coverage with the entity. Beginning the SR-22 process over again will certainly be necessary if your company submits an SR-26 prior to completing your SR-22 demand. motor vehicle safety.

MIS-Insurance offers cheap SR22 insurance policy that will conserve you money over the life of your plan. Affordable SR22 insurance coverage is readily available and also we will can assist you protect the ideal policy for you - car insurance. The factor is that each insurance company utilizes its criteria when evaluating your driving background. On the various other hand, California law forbids firms from enhancing rates or canceling your policy in the center of its term.

A drunk driving will instantly enhance your prices without thinking about additional rate increases and also reject you price cuts also if you were formerly getting an excellent motorist discount rate. Instead of paying $100 month-to-month for car insurance, a vehicle driver with no DUI background will just pay $80 regular monthly, thanks to the 20% good driver discount rate they obtain. bureau of motor vehicles.

5 Simple Techniques For How Can I Get Sr22 Insurance Without A Valid License?

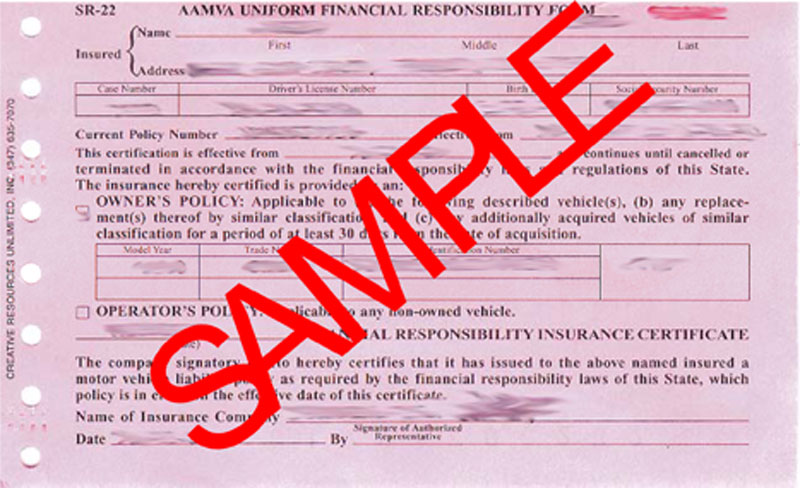

What you need to understand about SR-22 Declaring in The golden state When it involves issues concerning car insurance, our driving documents, and civil liberties as well as privileges, sometimes we are instructed points that merely are not real. liability insurance. Let's check out a few of one of the most common misconceptions and also misunderstandings relating to the SR-22 The golden state: What is the SR-22 Motorist Filing? An SR-22 is a certificate of insurance submitted by your insurance provider directly to the Department of Electric Motor Vehicles - auto insurance.

SR-22 Minimum Responsibility Purview The minimum obligation limits have to satisfy your state's needs. All you have to do is request your insurance business to file an SR-22 for you, then the insurance coverage business takes treatment of the remainder.

Stay Clear Of Future SR-22 Terminations and Suspensions Once you have your SR-22 insurance coverage, you intend to see to it it does not get terminated or suspended. You can do this by restoring it early. It must be renewed at the very least 15 days before it ends to ensure it isn't cancelled. The earlier you restore it, the more secure you'll be and the much less likely your SR-22 will be cancelled (car insurance).